UK Retail Inflation Report summary

September 2025

Period covered: Period covered: August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Inflation

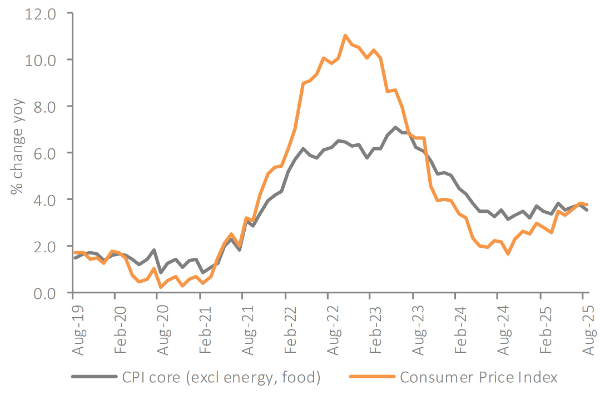

Headline inflation steady: CPI inflation held at xx% in August, unchanged from July and broadly in line with expectations. Prices rose xx% month-on-month, the same rate as last year. Inflation remains nearly double the Bank of England’s xx% target, supporting expectations that rates will stay on hold this week.

Services inflation slows: Goods inflation edged up to xx% in August, from xx% in July while services inflation eased slightly to xx%, down from xx%. Within services, weaker contributions from housing and transport offsetting strength in hospitality and accommodation.

Transport eases: Transport inflation slowed to xx% YoY in August, from xx% in July. Air fares rose just xx% between July and August, a sharp moderation from the xx% rise a year earlier, as school holiday timing skewed comparisons. Vehicle maintenance costs also eased but Motor fuels offset some of this weakness, with petrol and diesel both edging up on the month.

Food inflation rises again: Food and non-alcoholic beverages rose to xx% in August, up from xx% in July and marking the fifth consecutive monthly rise. Vegetables, cheese, and fish were key drivers, partly offset by weaker prices for cereals and oils. Supply issues after record-high summer temperatures continue to add pressure.

Restaurants and hotels increases: Inflation rose to xx% YoY in August from xx% in July, driven by higher hotel accommodation and canteen costs.

Costs backdrop: Rising commodity and shipping costs are feeding through to supply chains, keeping pressure on food and household goods. Oil prices have steadied but remain high enough to limit relief on transport and distribution, while elevated agricultural markets and shipping rates are adding to import costs.

Financial market reaction: Markets now see little chance of a September rate cut, with expectations shifting firmly towards November or later. Yields climbed and sterling strengthened slightly after the release, though sentiment remains cautious.

Inflation outlook: Inflation is proving stubborn, with headline CPI stuck at xx% and food inflation pushing higher again. While services inflation eased, underlying pressures remain. The Bank of England expects CPI to linger close to xx% through the autumn before easing more meaningfully in 2026.

Households are cautious in the face of unpredictable price movements, with evidence of stronger saving behaviour and softer discretionary spending. That uncertainty is feeding into more selective purchasing, with volatile costs shaping consumer behaviour.

The rate path has narrowed. A September rate cut has been ruled out, but November remains on the table if wage growth and services inflation moderate in the next couple of months. Interest rates are expected to loosen gradually in 2026, but the MPC is set to proceed carefully, weighing domestic stickiness against risks from global energy and food markets.

Take out a free 30-day trial subscription to read the full report >

CPI inflation held at 3.8% in August, unchanged from July and broadly in line with expectations

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis