UK Retail Inflation Report summary

February 2024

Period covered: Period covered: January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

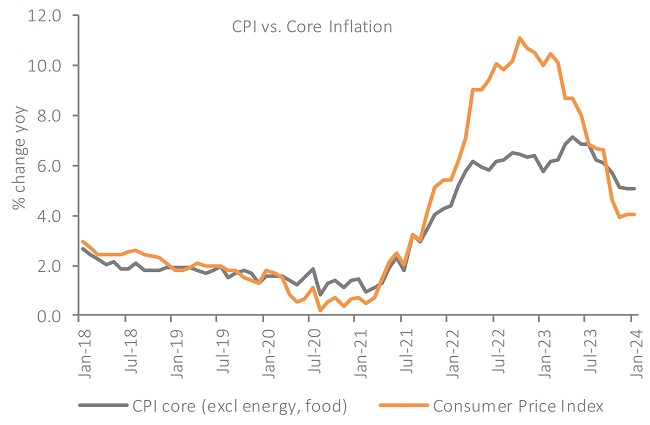

Inflation

Annual inflation remained unchanged at xx% in January, below economists’ forecasts of a rise to xx%. On a monthly basis, prices fell by xx%.

The closely-watched services inflation rate edged up to xx% (from xx% in December), slightly below expectations, while goods inflation fell to xx% (from xx%).

Upward pressure to the headline inflation rate was driven by January’s rise in the energy price cap, which pushed up energy prices, and an uplift in second-hand car prices (the first rise in xxxx months). This was offset by lower prices of furniture and household goods and a further easing of food inflation.

Within the furniture and household goods category, downward pressure came from the furniture and furnishings and carpets and other floorcoverings components which saw the annual inflation rate hit its lowest level since xxxxxxx.

Encouragingly, food inflation continued on a downward trajectory, rising by xx% YoY, from xx% last month. Notably, monthly food prices fell for the first time since xxxxx, down xx% in January, which was the largest monthly fall since xxxxx.

The largest negative contribution came from xxxxxxx with seven of the 11 sub-categories exerting downward pressure.

Inflation is expected to ease in the months ahead, with lower wholesale energy prices weighing on the next adjustment in the energy price cap in April, with expectations that prices could fall by as much as xx%.

This could see inflation reach its 2.0% inflation target in xxxxxx, increasing the likelihood of the Bank of England loosening monetary policy.

Take out a FREE 30 day membership trial to read the full report.

Inflation edge up in December

Source: ONS

Source: ONS