UK Retail Inflation Report summary

August 2023

Period covered: July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Inflation

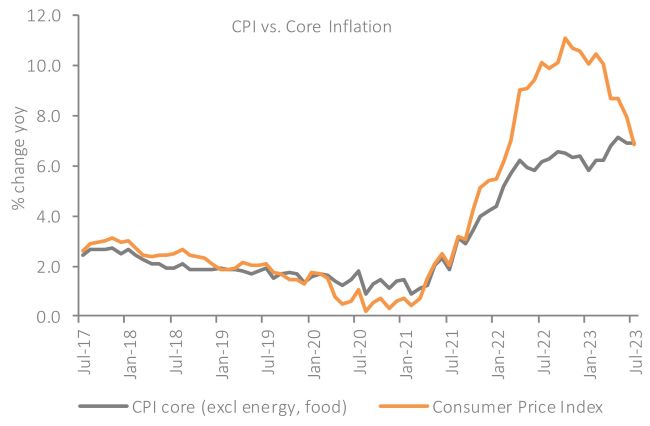

Headline inflation eased again in July, rising by xx% YoY from xx% last month – a xx-month low but slightly ahead of economists’ expectations.

However, core inflation, excluding food and energy prices, was stickier, remaining unchanged at xx% for the second consecutive month, above economists' expectations of it dipping to xx%.

The slowdown was predominantly driven by a record fall in gas prices and falling motor fuels inflation which decreased by xx% YoY.

Encouragingly, Food inflation also fell back (xx% YoY), supported by easing prices of essentials including milk, bread and breakfast cereals. MoM prices were up just 0.1% between June and July compared with a 2.2% rise in July 2022. But annual food inflation ultimately remains significantly up on a year ago.

Notably, the overall cost of raw materials continued to fall with input producer price inflation down xx% YoY.

Factory gate inflation (xx%) also fell into negative territory for the first time since xxx xxx, which should filter through to goods inflation in the months ahead. Goods inflation slowed to xx% in July from xx% in June.

However, services inflation remains stubbornly high, rising to xx% in July (from xx% last month), above the Bank of England’s estimate of it ticking up to xx%. Key drivers included a sharp rise in rental inflation (notably from registered social landlord rents) and a surge in airfares compared to a year ago. We expect the rises in these components to be temporary which should drive overall services inflation lower in the months ahead.

Take out a FREE 30 day membership trial to read the full report.

Inflation eases but remains high

Source: ONS

Source: ONS