UK Retail Industry Outlook Report summary

January 2021

Period covered: Q2 2020

The economic outlook heavily depends upon the evolution of the pandemic and the social distancing measures in place.

Trends including a shift to online and the need to repurpose stores have accelerated in recent months, at a time when the ability for retailers to invest is under pressure from depleting cash reserves.

As Government attempts to kick start the economy again, the relaxation of some Covid-related restrictions is likely to come up against a degree of precautionary behaviour by households and businesses. The economy, and especially the labour market, will therefore take some time to recover towards its previous path.

Critically, large parts of the industry reopened on 15 June the first time in nearly three months. Around half of non-essential retailers have opted for a phased approach to reopening stores.

Adhering to safety guidelines will be felt unevenly across the sector. The challenges and risks of reopening are clearly based on the characteristics of the in-store customer journey for each category:

- Density of products in-store

- Frequency of product contact

- Customer service proximity

- Average dwell times

- Footfall levels

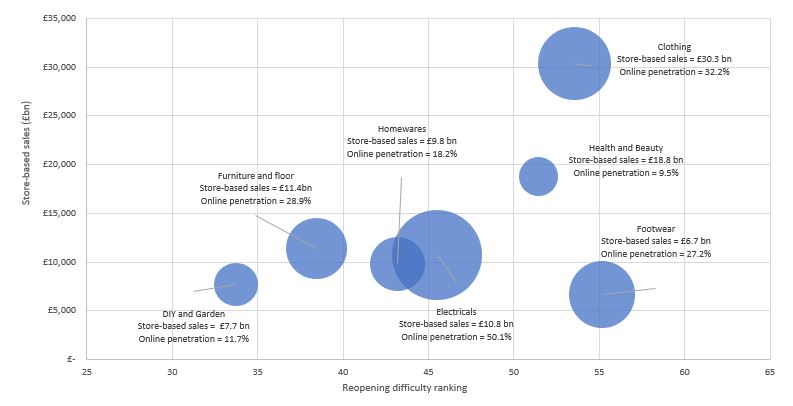

Using these characteristics, Retail Economics has conducted a cross-sectional analysis by category (e.g. clothing, electricals) and channel (e.g. high streets, retail parks), assessed across a range of Government guideline measures to produce a ‘Reopening Difficultly Ranking’.

Clothing, Footwear and Health & Beauty are likely to face the toughest challenges for reopening. Here, shared characteristics include densely packed products in-store, the frequency of customer-product contact, high levels of footfall and the proximity of customer service (e.g. trying on a pair of shoes often involves face-to-face assistance from staff who collect multiple boxes of shoes, and help with fitting – even measuring children’s feet). Government guidance then states shoe retailers have to store ‘tried-on shoes’ for two days before re-displaying if they cannot be rigorously cleaned.

However, the guidance is open to interpretation. Kurt Geiger have stated that shoes will be quarantined for a 24-hour period before being put back on display following contact with a customer, whereas Dune is asking customers to wear disposable pop socks before trying shoes on.

Given the challenges for some parts of the industry, retailers are looking to lean on online channels, which includes attempting to merge their physical and online propositions more closely to support sales.

The maturity of online operations will play a crucial role in identifying which sectors and retailers could be most adaptable. Figure 1 (p.5) illustrates the size of store-based sales by sector, against the difficulty ranking of reopening stores and the penetration rate of online sales.

For example, the Health & Beauty sector generated £18.8bn through stores in 2019, with online accounting for just 9.5% of total sales. Retailers will struggle to leverage their online capabilities to shift spending towards this channel, and will find it more difficult to open stores while maintaining social distancing, hygiene measures and workforce management.

Clothing retailers face a similar level of difficulty in reopening physical stores, albeit on a larger scale. The online proposition is far more developed and so merging the physical retail experience with online fulfilment is likely to become a more visible feature for retailers to support overall demand.

The challenge of unlocking stores by sector

Source: Retail Economics

Source: Retail Economics