UK Online Retail Sales Report summary

September 2025

Period covered: Period covered: 03 - 30 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

Online retail sales rose xx% year-on-year in August, improving on the xx% gain a year ago. Average weekly online sales reached £xxm, up from £xxm in 2024. Online accounted for xx% of total retail sales, slightly higher than last year’s xx%, suggesting steady digital penetration.

Key drivers

Seasonal demand and weather: August was a warm, drier-than-average month, featuring a mid-month heatwave which supported summer food and apparel ranges.

Promotions and clearance: Heavy discounting played strongly online, particularly in fashion and department store categories.

Digital platforms amplified clearance events with flash sales and personalised offers, helping to shift summer stock and maintain engagement through quieter weeks.

Back-to-school peak: Technology was a key online driver. Laptops, tablets, and accessories saw sharp demand as families shopped for the new school year. In contrast, online schoolwear was soft, echoing physical store trends as parents delayed purchases or economised with second-hand purchases.

Footfall

With total UK footfall up just xx% year-on-year, online continued to act as a natural complement. Regional city centres and coastal towns benefited from summer tourism, but shoppers increasingly split purchases between in-person browsing and digital ordering.

Macroeconomic backdrop

Consumer sentiment improved modestly in August, with GfK’s index rising to -xx, its best level since late 2024. The Bank of England’s rate cut to xx% earlier in the month gave households some relief on borrowing costs, though sentiment weakened again heading into September as talk of tax rises resurfaced.

Inflation remained sticky at xx%. Food inflation edged higher to xx%, extending a five-month run of increases.. Rising petrol and diesel costs added to pressure, offsetting falls in airfares and seasonal accommodation prices. This meant household budgets stayed tight as wage growth ran at xx% in the May-July period, easing on the previous reading. Wider data from the labour market showed that it continued to soften. Unemployment rose to xx% and vacancies fell for a fourteenth straight month. For online retail, this mix translated into cautious optimism.

Outlook

August confirmed that online remains firmly embedded in UK shopping habits, with steady growth across most categories and pureplay retailers maintaining an advantage. Clearance events drove much of the activity, and while this supported volumes, it came with thinner margins.

Looking ahead, digital channels will be tested by the Autumn Budget and shifting consumer sentiment. The strength of online lies in flexibility, from quick promotions to convenience-led fulfilment, but with inflationary pressures persisting, growth through the autumn will depend less on new demand and more on winning share from physical retail and capturing cautious seasonal spend.

Take out a FREE 30 day membership trial to read the full report.

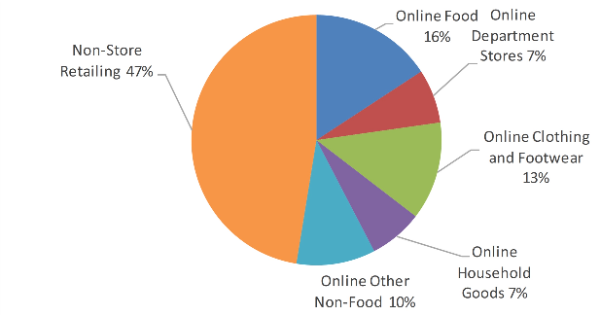

Proportion of online retail sales by category

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis