UK Online Retail Sales Report summary

May 2024

Period covered: Period covered 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online Retail sales

Online retail sales growth fell by xx% YoY in April (value and non-seasonally adjusted), against a xx% rise a year ago.

Easter distortions, unsettled weather and ongoing economic uncertainties weighed on performance this month:

Easter distortions: the timing of Easter this year compared to a year ago distorted top line growth with Easter included in March’s trading period but April’s a year ago, pulling sales forward.

This led to all but two categories reporting a decline in online sales growth.

Resultantly, analysing spending over a two-month period across March and April provides a more robust picture of underlying demand. Using this measure shows online retail sales growth of just xx% YoY, compared to xx% across the same two months in the previous year.

Unseasonable weather: the weather in April persisted much like the conditions observed in recent months, largely unsettled and wet, disrupting typical sales patterns, particularly in the Clothing & Footwear category.

Following Storm Kathleen, the 11th named storm of the 2023-24 season at the start of the month, April received 155% of average rainfall and was the wettest April for 12 years.

These conditions impacted footfall; alongside national rail strikes which left consumers unable to reach shopping destinations. Footfall declined xx% YoY across all retail destinations in April.

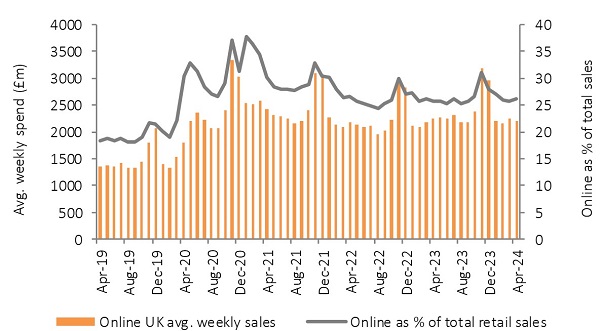

This contributed to the online proportion of sales edging up to xx% in April from xx% a year earlier.

Underlying environment

Households continue to navigate the economic backdrop which showed signs of improvement in April.

Headline inflation remained on a downward trajectory, albeit coming in slightly ahead of forecasts at xx% as the recent cut in the energy price cap was realised in the numbers. Food inflation also eased to its lowest level since xxxx.

On a positive note, real wages grew at the fastest rate for two years in the first quarter (xx%) and National Insurance Contributions were reduced in April, boosting household budgets.

Confidence edged higher, rising by two points to xx. But consumers ultimately remain cautious, particularly when it comes to large purchases. The major purchases index stood just three points ahead of the same period a year ago in April (25 vs 28) according to GfK’s consumer confidence barometer.

Take out a FREE 30 day membership trial to read the full report.

Online penetration improves

Source: ONS, Retail Economics Analysis

Source: ONS, Retail Economics Analysis