UK Online Retail Sales Report summary

March 2024

Period covered: Period covered: 28 January - 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online Retail sales

Online retail sales growth rose by xx% YoY in February (value and non-seasonally adjusted), against a xx% decline a year ago.

Poor weather conditions, more time spent at home and an improving backdrop impacted performance

Inclement weather: February was generally an unsettled month. Temperatures were warmer than average, with the UK recording its second warmest February on record. This would typically provide a boost to spending on seasonal collections.

However, the accompanying extensive rainfall, which saw Southern England and East Anglia record its wettest February on record, meant consumers were reluctant to venture out to physical locations.

More time at home: resultantly more time was spent at home, with footfall falling by xx% YoY across retail destinations (MRI), exasperated by ongoing rail strikes at the beginning on the month. High street footfall disappointed, declining xx% YoY while shopping centres fared slightly better (xx%).

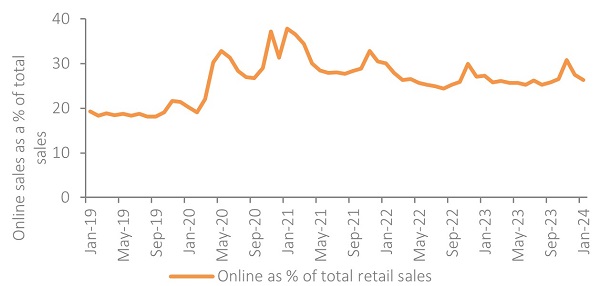

This supported online performance with the YoY growth rate edging up in February with the online penetration remaining broadly in line with last year’s rate at xx%.

More time at home: after a busy festive period, households spent more time at home with spending on takeaways increasing as a result, rising xx% YoY in January (Barclays).

However, this didn’t have a positive uplift on the online channel with the online penetration rate falling to xx% in January, lower than the xx% rate a year ago and the weakest penetration rate since September 2023.

Complex customer journeys

Retail brands, are facing an intensified battle for differentiation in a hyper-competitive arena.

Success hinges on mastering an increasingly complex customer journey where online and offline intertwine, consumer loyalty is fluid, and expectations around delivery have reached new heights.

We are now seeing a gulf emerge in the retail landscape. Those retailers that have put digital transformation and data at the heart of their operations, invested in infrastructure, created the right culture, and leaned in heavily on these skills are pulling away from those who have not.

Take out a FREE 30 day membership trial to read the full report.

Online penetration stabilises

Source: ONS, Retail Economics Analysis

Source: ONS, Retail Economics Analysis