UK Online Retail Sales Report summary

July 2023

Period covered: Period covered: 29 May – 1 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online Retail sales

Online retail sales growth rose 00% YoY in June (value and non-seasonally adjusted), against a soft comparison a year ago.

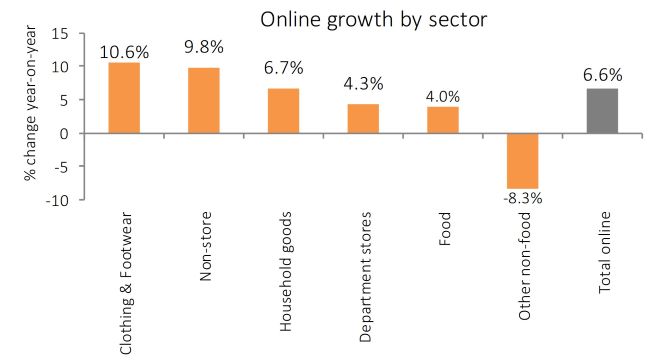

Average weekly sales totalled £00 in the five-week trading period, with all but one category recording a rise in June.

Clothing & Footwear (00%) was the standout performer, with record temperatures driving demand for spring and summer lines, supported by mid-season sales. Swimwear and sandals were said to be popular.

Promotional activity was also a key driver of sales within the Household Goods category (6.8%) which reported its best result since 00000 000.

Online performance was influenced by several key drivers:

Weak annual comparisons: Last June, online sales declined 8.9% YoY as cost-of-living pressures intensified amid surging food inflation and rising petrol prices.

Warm weather: it was the hottest June on record with an average temperature of 15.8°C, 2.5°C above the usual June average. With more people encouraged to spend time outdoors, seasonal categories such as gardening, apparel and beauty outperformed in what was the sunniest June in 66 years.

The dry and sunny weather conditions encouraged consumers to shop in physical locations with footfall rising 3.7% from May according to MRI Springboard.

However, online penetration remained stable at around a quarter (24.9%) of total retail sales for the fifth consecutive month and is broadly in line with last year’s proportion (25.2%).

Father’s Day: Families came together to celebrate which coincided withgood weather, supporting demand of barbeque foods and cold treats such as ice cream.

Sporting events/festivals: Numerous concerts and sporting events took place during the month including Glastonbury, the FA Cup and Champions League Finals, creating a feel-good factor amongst consumers.

Earnings growth: Despite headline inflation easing to 7.9% in June, the latest data on earnings growth showed regular pay continued to rise at a record pace, up 7.3% in the quarter to May.

Inflation: Slowing levels of inflation eased the pressure on household budgets although volume growth remains under pressure.

These positive factors provided a boost to confidence, resulting in a three-point rise to -24 in June, its sixth consecutive month of improvement and best result since January 2022.

Take out a FREE 30 day membership trial to read the full report.

Online sales growth remains the highest since September 2021

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis