UK Online Retail Sales Report summary

July 2021

Period covered: Period covered: 30 May – 3 July 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online retail sales fell by 00% YoY (value and non-seasonally adjusted) in June – a record low against a 74.2% rise in June 2020.

Sales growth was impacted by strong comparisons a year ago, the transference of spending back to physical locations, and shift in spending to other parts of the economy such as hospitality.

In June 2021, this strong comparison coupled with non-essential stores and hospitality being open for the whole of the trading period, the online penetration rate fell to its lowest level since March 2020, down to 26.1%. Notably however, it remains considerably ahead of pre-pandemic levels (18.3% in June 2019).

Resultantly, category performance was weak with all but one category reporting sales declines in June. Online Department Stores, Other Non-Food and Food were weakest performers.

Online Clothing & Footwear was the standout performer, recording sales growth of 00% YoY against a 33.6% rise a year ago.

The category continued to be supported by pent-up demand, while warmer weather at the start of the month boosted demand for summer outfits and footwear, helped by the reopening of indoor hospitality on 17 May.

Many consumers will revert to previous shopping habits once Covid impacts recede, but a significant proportion of consumers have spent more time browsing, researching and purchasing online, with these new online behaviours cemented having broken through the initial barriers of setting up online accounts, entering payment details and overcoming issues of trust and convenience.

Our research shows that almost four in ten consumers think their shopping habits will change permanently due to Covid-19. The crisis has been a catalyst for structural change. Online sales hit record highs during lockdowns as consumers embraced e-commerce options for the first time across many categories, while online dependency grew for others.

Inevitably, many consumers will revert to previous shopping habits once the impact of the pandemic recedes, but a significant proportion of consumers have spent more time browsing, researching and purchasing online, with these new online behaviours cemented having broken through the initial barriers of setting up online accounts, entering payment details and overcoming issues of trust and convenience.

Our research identifies three distinct consumer-driven shifts that differ by category…

Take out a free 30 day membership trial to read the full report >

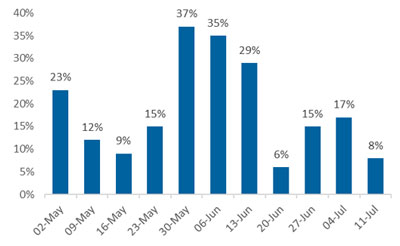

Next - Full price sales by week

Source: Next Financial Results

Source: Next Financial Results