UK Online Retail Sales Report summary

January 2022

Period covered: Period covered: 28 November – 01 January 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online retail sales growth fell by 00% YoY in December (value and non-seasonally adjusted), against a 45.6% rise a year ago. The strongest performance since September.

The Omicron variant, first detected in the UK at the end November, dominated headlines in December.

00% of consumers were in some way concerned about the new variant, according to our research early in the month.

Resultantly, 00% of consumers said they would try to avoid physical locations ‘as much as possible’ when Christmas shopping.

Surging case numbers saw the introduction of Plan B restrictions (10 Dec) which included the reintroduction of working from home guidance and mask wearing in shops.

For many consumers, memories of last December’s disruptions impacted their shopping behaviours this year.

A year ago, tighter restrictions were introduced across London and the South East (19 Dec 20) as a result of the newly discovered Delta variant. Shops and hospitality venues were closed, with Christmas plans cancelled for nearly 18 million people. The rest of the country saw their plans scaled back.

With no lockdowns imposed this year, consumers voluntarily shielded themselves at home, limiting contact with others and visits outside to protect their plans for the festive period.

Overall footfall across all retail destinations declined to its weakest level since August.

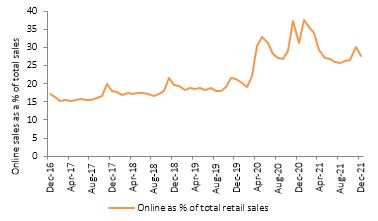

Against this backdrop, consumers reverted to previously learnt pandemic buying habits which pushed online sales performance to a three month high. Online penetration remained elevated at 00%.

This follows November’s robust performance as consumers brought forward their Christmas purchases. Concerns over product availability and Black Friday promotions were supportive factors.

Notably the penetration rate rose for the third consecutive month to 30.1% of overall retail sales

Take out a FREE 30 day membership trial to read the full report.

Online penetration slows but remains ahead of pre-pandemic levels

Source: ONS

Source: ONS