UK Homewares Sector Report summary

September 2023

Period covered: Period covered: 30 July – 26 August 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

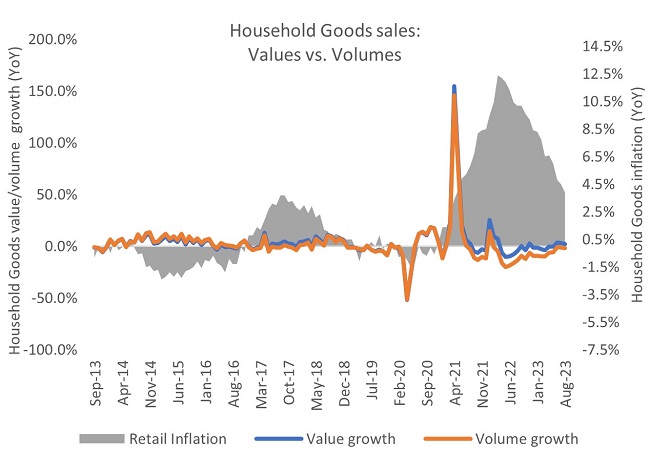

Homewares sales increased by xx% YoY in August, according to the Retail Economics Retail Sales Index.

ONS data shows the wider Households Goods category faced xx% YoY shop price inflation in the month, pointing to a decline in sales volumes.

Indeed, ONS data shows sales volumes in the wider Household Goods category fell by xx% YoY in August.

Housing market cools

Demand for Homewares continued to be impacted by a weak housing market. UK house prices fell 4.6% YoY in August, and 1.9% on a monthly basis (Halifax).

This can be attributed to the impact of consecutive interest rate rises, but intensified by a seasonal dip in activity and annual comparisons with record high prices last year.

As a result, many households that would otherwise have considered moving are delaying where possible, with potentially to spruce up homes as an alternative to moving.

While retailers such as Kingfisher have reported increased demand for “expensive” home improvement projects, driven by affluent consumers who own their homes outright and have a cushion of savings, the Homewares market continues to be driven by smaller household purchases.

Tough macroeconomic conditions

August, the lowest reading since February 2022, with core inflation also falling below forecasts in the month.

Earnings growth outpaced inflation for the second consecutive month in August, resulting in a five-point increase in consumer confidence to -25 in the month, following a sharp decline in July (GfK).

However, the measure remains firmly in negative territory and the effects of changes in confidence on sales levels tend to lag by several months.

In addition, an increase in interest rates from 5% to 5.25% at the beginning of August weakened the housing market, as well as putting further financial pressure on mortgagers.

Although subdued, Homewares sales were stronger than both Furniture & Flooring and DIY & Gardening, reflecting typically lower transaction values.

Take out a FREE 30 day membership trial to read the full report.

UK households are set to be £3 billion worse off this Christmas (Q4 2023 vs. Q4 2022)

Source: Retail Economics

Source: Retail Economics