UK Homewares Sector Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales fell by xx YoY in February, against a weak xx decline a year earlier, according to the Retail Economics Retail Sales Index.

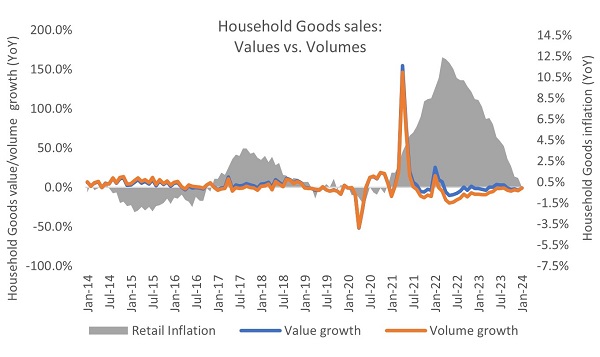

The category is facing deflation, as input costs ease and retailers attempt to drive growth through value and promotions. The wider Households Goods category faced a xx decline in prices in February.

Dampened demand

Homewares sales continued to decline in February despite more time spent at home. The wettest February on Met Office records in Southern England saw footfall drop xx YoY across retail destinations (MRI), exacerbated by train strikes at the start of the month. This was driven by a xx decline across high streets, albeit retail parks saw a slight increase in footfall by xx.

Households spending more time indoors had a positive impact online, with online sales across retail rising by xx YoY in February. However, home-related categories failed to benefit from this uplift, with online Household Goods sales declining by xx in February.

Consumers instead focused on home entertainment during the wet half term break. Key televised events such as the Super Bowl, BAFTA Film Awards and new releases including One Day encouraged households to enjoy nights-in. This helped digital content and subscriptions grow at its strongest rate since xxx xxx (xx, Barclays).

Nonetheless, the performance of Homewares was stronger than big-ticket home-related categories such as Furniture & Flooring, as households more easily committed to purchases of low-cost items such as cushions and cooking items in February.

Low confidence

Homewares finds itself competing for household discretionary spending against non-retail sectors like events and holidays, affected by low consumer confidence.

Retailers, including Ikea, have reduced prices to stimulate demand amid post-inflation deflation, with the Households Goods category experiencing a price drop.

Inflation has reached its xxx rate since xxx at xx YoY, aiding in real earnings growth, despite ongoing consumer pessimism reflected by GfK’s confidence index.

Projections suggest real household disposable income will return to pre-pandemic levels by xxx xxx, though spending intentions are dampened by higher interest rates, particularly among younger, middle-income households facing mortgage or rent renewals.

Take out a FREE 30 day membership trial to read the full report.

Inflation has eased substantially but volumes remain in decline

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis