UK Homewares Sector Report summary

July 2023

Period covered: Period covered: 28 May – 1 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

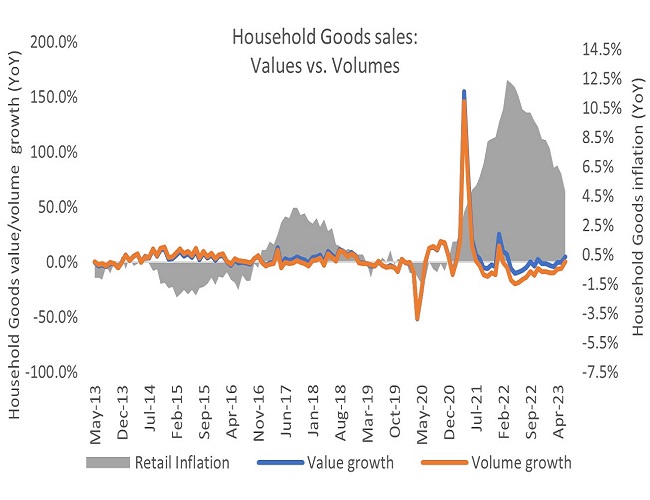

Homewares sales fell 0.7% YoY in June, according to the Retail Economics Retail Sales Index.

Retail Economics estimates Homewares inflation was in the region of 00% YoY in June, while ONS data shows the wider Households Goods category faced 00% YoY shop price inflation in the month, pointing to a narrowing gap between sales values and volumes.

Housing market cools

Demand for Homewares is being disrupted by the turbulent housing market. UK house prices fell 2.6% YoY in June, the largest annual decline since 2011 (Halifax).

This can be attributed to strong price growth during the summer of 2022 as well as the impact of repeated interest rate rises, which reached 5% in June.

This has had a significant effect on indicators, including buyer enquiries, sales expectations, and price expectations. which are regressing towards the levels last seen in Q4 2022, after steadily improving throughout the course of the year (RICS).

Although many households may purchase Homewares products to refresh their home environment as an alternative to a house move, the effects of high interest rates will continue to put downward pressure on Homewares sales volumes.

Additionally, renters face eroding budgets as rents rise amid limited availability of rental properties. A net balance of +53% of estate agents anticipate rental prices rising (RICS).

Sector outlook

Inflationary pressures are set to ease in the second half of the year. It comes as last year’s strong increases in the cost of key essentials such as energy and fuel are not being repeated at the same rate this year, easing the pressure on discretionary budgets amid recent record earnings growth (outside of the pandemic period), up 7.3% in the quarter to May (ONS).

However, growing optimism for the economy that characterised the first six months of the year is beginning to falter.

Retail Economics and Grant Thornton research shows that the UK is only 00 of the way through the cost-of-living crisis, with 00 months of spending power erosion yet to come.

Retail Economics forecasts Homewares sales to rise by a modest 00% YoY in 2023, with sales ticking higher to almost £00bn. This follows a projected decline of 00% in 2022.

Given high inflation, this represents a decline in Homewares sales volume terms over 2023.

Take out a FREE 30 day membership trial to read the full report.

Homewares sales volumes remain in decline.

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis