UK Homewares Sector Report summary

January 2021

Period covered: Period covered: 01 Dec 2020 – 31 Dec 2020

Retail sales rose by 0.8% in December, year-on-year, according to Retail Economics. Total online retail sales were up 45.8% in December, value and non-seasonally adjusted, according to ONS. Shop price inflation edged down by 0.6% in December, excluding fuel, according to ONS. Homewares retail sales increased by 2.8% in December year-on-year, value and non-seasonally adjusted, according to Retail Economics. Average weekly sales for Homewares were £232m in December, according to Retail Economics.

Homewares –Retail Economics Index: December 2020

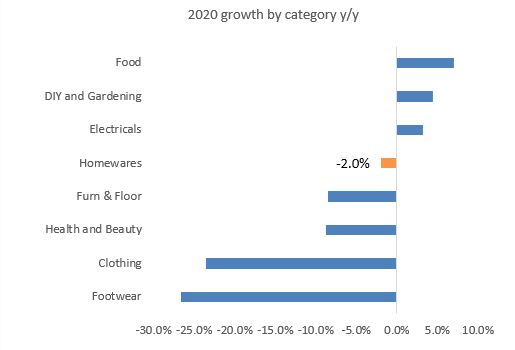

Homewares sales recorded steady growth in December, rising 2.8% year-on-year. The sector remains one of the most resilient in non-food retail, driven by people spending more time at home and greater choice and availability of products online as retailers quickly adapt to changing customer journeys. Over the full-year, homeware sales totalled £12.8bn in 2020, down 2.0% year-on-year. This is a respectable performance considering the devastating impact of Covid-19 on the economy and consumer… read more

Christmas comes early

Christmas spending in 2020 was like no other. November’s national lockdown and tiered restrictions throughout December disrupted the traditional timing of consumer spending while also affecting the distribution between channels and retailers. The distribution of weekly sales in the run-up to Christmas followed a very different path to previous years. Many consumers brought forward their Christmas spending into November to avoid concerns about availability and to ensure online deliveries were completed on time. A prolonged Black Friday month also proved popular for consumers… read more

Transference of Spending

Fears over rising virus infection rates and uncertainty around store openings (non-essential stores closed from 19th Dec for Tier 4 areas) meant many shoppers sought out alternative retailers and channels for their purchases. Our research found that almost half of consumers shopped at different retailers than they would normally choose in order to complete their Christmas… read more

Home is where the heart is

Spending on homewares held up well over 2020, defying the economic shock caused by Covid-19. With people spending more time at-home for both work and pleasure, consumers are prioritising home-related purchases to improve their life indoors. With Covid-19 restrictions expected to last until the summer, Homewares is set to remain a bright spot in non-food retail in 2021. A rush to complete house moves prior to the end of the stamp duty holiday in March should provide upside support to homewares spending over the coming months as new homeowners invest in… read more

Online Household Goods –Office for National Statistics – December 2020

Online Household Goods sales growth increased by 34.0% year-on-year in December, according to the ONS. This was the weakest growth figure since February 2020 before the crisis began. The slowdown in online sales growth in December is less to do with the reopening of physical stores, and more a reflection of the strong comparative in December 2019, when the late timing of Black Friday inflated sales figures for that… read more

Macro Factors – Housing Market Activity

Mortgage approvals accelerated further in November to 104,969 up from 98,338 in the previous month and significantly ahead of the previous six-month average of 65,733. It was the sharpest rise in approvals since August 2007. Notably, mortgage approvals in the 11 months to November 2020 are broadly in line with the corresponding period in 2019 and are up by 61% compared to the same month a year ago. The number of re-mortgaging approvals edged up, totalling 35,107 in November up from 33,089 in… read more

Macro Factors – Consumers

Household consumption rose by 19.5% in the third quarter of 2020. The main drivers were increased spending in restaurants and hotels, and transport. Household consumption remains 9.8% below its Q4 2019 level. GfK’s Consumer Confidence measure improved by seven points to -26 in December, this is 11 points lower than a year ago. All five measures within the index increased compared to the previous… read more

Macro Factors – Ipsos Retail Performance

Footfall fell by 53.7% in December 2020 year-on-year, according to latest figures from Ipsos Retail Performance (which measures footfall in over 4,000 non-food stores across the country). The steepest declines in footfall for the month of December were in London & South East (-61.9%) followed by Scotland & N Ireland (59.2%) and The Midlands (-52.1%). Similarly, footfall fell in SW England & Wales (-50.9%) and Northern England (-44.8%) … read more

Macro Factors – Labour Market

The latest ONS labour market data shows a significant increase in unemployment rate while employment rate continues to fall. Though redundancy levels reached record highs, total hours worked increased from the low levels in the previous quarter. The number of paid employees fell by 2.7%, some 828,000 employees in December compared with February 2020 according to flash estimates using PAYE data – around 52,000 higher than in… read more

Macro Factors – Earnings

For November in nominal terms (unadjusted for price inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £531 per week before tax and other deductions from pay – up from £510 per week a year earlier. Average totals pay (including bonuses) for employees in Great Britain was £562 per week before tax and other deductions from pay – up from £543 per week a… read more

Macro Factors – Costs, Prices and Margins

Sterling’s trade weighted index dipped marginally in December, down 0.3% on the previous month as Brexit uncertainty and rising coronavirus cases impacted the index. In terms of exchange rates, the £/$ rate is currently around 1.36, while £/€ rose to around 1.12. Both commodity indexes we track appreciated in January. Indeed, the Thomson Reuters CRB Index fell by 3.9% year -on -year from -11.9% in December, compared to a 17.6% annual fall for the GSCI Commodities benchmark. The rise was driven by expectations of strong international demand during 2021, particularly from… read more

Factory gate inflation (output) slowed in December, rising to -0.4% year-on-year from -0.6% in November. On a month-on-month basis, output inflation rose by 0.3%, unchanged from the previous month. Two product groups provided a negative contribution to the annual output inflation rate in December. Indeed, Petroleum provided the largest downward contribution of 1.53 percentage points (pp) to the annual output rate, with inflation falling by 26.6% year-on-year, driven by refined petroleum products. Paper and printing products displayed the second-largest downward… read more

Respectable performance in difficult circumstances

Source: Retail Economics

Source: Retail Economics