UK Health & Beauty Sector Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx YoY in February, against a sharp rise a year ago when sales also rose by xx, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The category remained the strongest performing Non-food category and was the only one to see growth in February.

Performance was influenced by several key drivers:

Strong annual comparative: a year ago, top line growth was supported by surging inflation with a basket of health and beauty products rising by over 10%. This compares to around c.6% this year.

Valentine’s Day: typical gifting items sold well during the month, with demand for small ticket items such as cosmetics and perfumes outperforming big ticket expenses.

Record wet weather: February was generally an unsettled month. Temperatures were warmer than average, with the UK recording its second warmest February on record.

However, the accompanying extensive rainfall, which saw Southern England and East Anglia record its wettest February on record, meant consumers were reluctant to venture out to physical locations.

Resultantly more time was spent at home, with footfall falling by 2.2% YoY across retail destinations (MRI), exasperated by ongoing rail strikes at the beginning on the month. High street footfall disappointed, declining 3.5% YoY while shopping centres fared slightly better (-2.3%).

Increased spending outside of retail: There was growing evidence that spending on travel was being prioritised for some, with travel agents rising by 10.1%, just ahead of airlines (9.6%) spend. Notably, airlines, such as Jet2, have lifted profit guidance off the back of bookings for summer holidays being well ahead of expectations.

This should support sales growth within the category as consumers stock up on holiday essentials such as suncream.

Take out a FREE 30 day membership trial to read the full report.

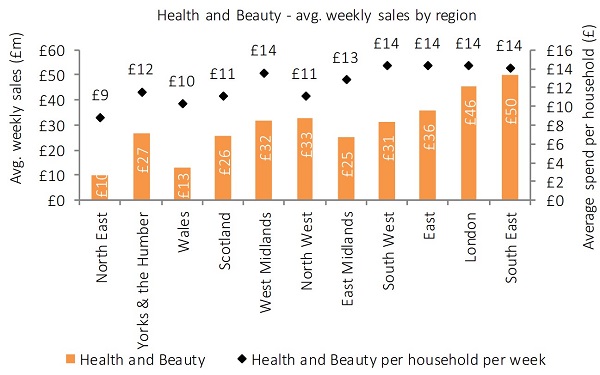

North East spends the least on Health and Beauty per week

Source: Retail Economics

Source: Retail Economics