UK Health & Beauty Sector Report summary

July 2023

Period covered: Period covered: 28 May – 1 July 2023

3 minute read :)

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales increased 00% YoY in June, against a 00% rise a year ago, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Growth improved on the previous month, with the category remaining the top performing non-food category in June.

The sector was supported by:

Warm weather: it was the hottest June on record with an average temperature of 15.8°C, 2.5°C above the usual June average. With more people encouraged to spend time outdoors, beauty outperformed in what was the sunniest June in 66 years.

Sporting events/festivals: Numerous concerts and sporting events took place during the month including Glastonbury and Royal Ascot, drive demand for skincare and beauty products.

Summer travel: Sun protection was in high demand amid record temperatures and preparation for summer holidays as the end of the school year approached.

Earnings growth: Despite an easing in headline inflation in June, the latest data on earnings growth showed regular pay continued to rise at a record pace, up 7.3% in the quarter to May.

Inflation: Slowing levels of inflation eased the pressure on household budgets although volume growth remains under pressure.

Sector outlook

Retail Economics forecasts 00% growth in Health & Beauty sales in 2023, with sales reaching £00bn, following strong growth of 00% in 2022.

Online is set to account for 00% of Health & Beauty sales in in 2023, up from 00% in 2022 and significantly above 2019’s pre-pandemic level of 00%.

Retail Economics projects a 00% compound annual growth rate (CAGR) for Health & Beauty sales through to 2027, with sales reaching £00bn by the end of the period.

Take out a FREE 30 day membership trial to read the full report.

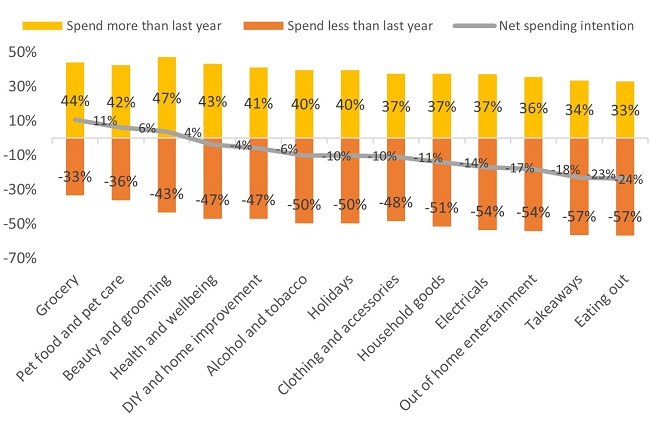

Consumer spending intentions by category: How do you intend to spend on the following categories this financial year (to April 2024)?

Source: Retail Economics, Grant Thornton

Source: Retail Economics, Grant Thornton