UK Health & Beauty Sector Report summary

January 2024

Period covered: Period covered: 26 November - 30 December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx% YoY in December, against a strong rise a year ago when sales rose by 6.2%, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The sector remained the strongest non-food category, outperforming amid typical gifting purchases.

On the beauty side, households are turning to affordable, feel-good indulgences, such as cosmetics and fragrances.

Meanwhile on the health side, a harsh month for winter viruses drove shoppers to cough lozenges, decongestants and the like. This was underlined by hospital flu cases jumping six-fold in December compared to November, as cases of flu and Covid in the community soared.

IMRG reported that online health & beauty sales came out on top, recording a xx% rise YoY. Skincare (+xx% YoY) was the best performing category while beauty (+xx% YoY) also reported substantial growth.

Performance was influenced by several key drivers:

Annual comparatives: A year ago, consumers were in a celebratory mood in what was the first restriction-free Christmas in three years. This led to consumers wanting to treat loved ones despite ongoing pressures on their household budgets. Postal strikes and a bad flu season also supported performance.

Demand pulled forward: This year, heavy discounting throughout November appears to have pulled demand forward at the expense of December sales.

Real wage rises: Wage growth, continues to outpace inflation with regular pay rising by 6.6% in the quarter to November (ONS) easing pressure on household budgets, although its likely to take some time before budgets fully recover from the pressures of the last couple of years.

Spending outside of retail: Christmas is typically a time where gatherings with family and friends increase. This year was no exception with sales at pubs, bars and clubs rising by 7.9% YoY.

Restaurants also reported their best performance since August, although spending remained in decline (-8.8%, Barclaycard). This supported spending within the beauty component.

For consumers, the feelgood factors around the festive season saw consumer confidence rise two points to -22 in December, its highest level since the start of 2022.

Take out a FREE 30 day membership trial to read the full report.

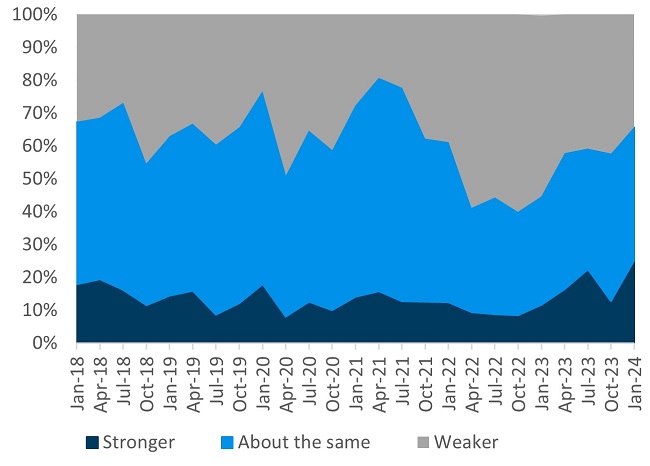

Outlook for personal finances improves but caution remains

Source: Retail Economics Shopper Sentiment Survey, January 2024, 2,000 nationally representative households

Source: Retail Economics Shopper Sentiment Survey, January 2024, 2,000 nationally representative households