UK Health & Beauty Sector Report summary

December 2023

Period covered: Period covered: 29 October – 25 November 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx% YoY in November, against a xx% rise a year ago, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The sector remained the strongest non-food category, with promotional events, Christmas gifting and beauty advent calendars all helping to drive a continued strong performance.

Performance was influenced by several key drivers:

Easing inflation (+/-): annual inflation fell to 3.9% in November from 4.6% in the previous month, surprising forecasters who had predicted a 4.4% reading. However, consumers are still operating in a squeezed environment. Overall food inflation is up almost xx% in the two years to November 2023, compared to just xx% in the ten years to November 2021.

Some Health and Beauty products also continued to experience higher inflation levels than the headline rate including liquid soap (xx%), deodorant (xx%), women’s hair colourant (xx%) and shampoo (xx%).

Weather disruption (-): Stormy weather in November impacted people’s desire to shop on the high street, with Storm Ciaran bringing severe winds and rain to southern England early in the month, and Storm Debi bringing strong winds to Northern Ireland, North Wales and north-west England in the middle of the month.

Cold weather set in later in the month, with the Met Office issuing a weather warning for snow on 28th.

Autumn statement: (-/+): The Autumn statement brought mixed news for the sector. A 9.8% minimum wage rise means an increase to £11.44 per hour from April – while this is good news for consumer spending, it will mean higher wage bills for retailers.

A freeze on rates multipliers for small businesses and an extension of 75% business rates relief offered vital support for independents, but no support for larger retail businesses. The statement shied away from broader long-term reform of business rates.

There was bad news for businesses relying on tourist trade, tax-free shopping was not reinstated; in better tax-related news, the 0% VAT rate was extended to include period underwear following the scrapping of sales tax on other period products in 2021.

Falling living standards (-/+): Real household disposable incomes are set to fall again in 2024, with inflation outpacing wage growth. Inflation is not expected to return to its 2.0% target until 2025. While this is bad news for consumer spending overall, consumer behaviour so far during this period of constrained spending suggests that health and beauty may continue to benefit from these dynamics.

Take out a FREE 30 day membership trial to read the full report.

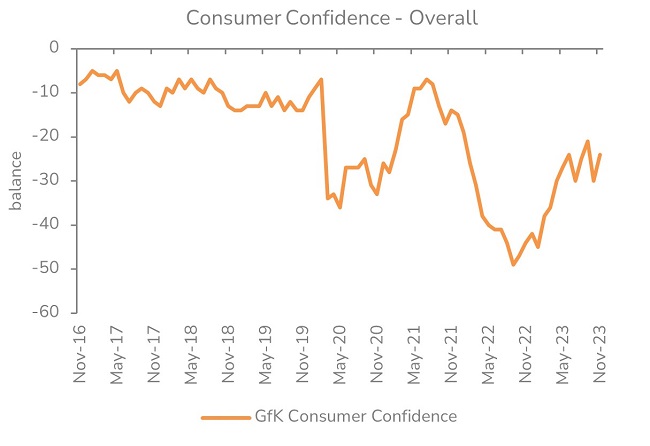

Consumers cautious at start of golden quarter

Source: GfK

Source: GfK