UK Health & Beauty Sector Report summary

April 2024

Period covered: Period covered: 25 February – 30 March 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx% YoY in March, against a rise of xx% in March 2023 according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The category remained the xxxx performing non-food category, with xxxx (xx%) the only other non-food category to record xxxx.

Month-on-month growth slowed to xx% from xx% in February, suggesting a xxxx of growth in the category.

Performance was influenced by several key drivers:

Mother’s Day: Mother’s Day had a muted impact on retail sales, with consumers preferring to spend on leisure instead.

The CGA/RSM Hospitality Tracker (measuring sales trends in the pub and restaurant market) showed that overall like-for-like sales increased xx% YoY in March supported by Mother’s Day and St Patrick’s Day.

Barclaycard data showed that bars, pubs & clubs spending rose by xx% in March 2024 compared to xx% in February, while cinemas enjoyed their busiest day of the year so far following the UK release of “Dune: Part Two”.

Dull and wet weather: March was another unsettled month weather wise, with some counties in England receiving their entire average rainfall by the middle of the month. Temperatures were mild, however.

Despite the rain, footfall rose over the month according to data from MRI Software. Overall footfall in March rose by xx% compared to February, and by xx% on an annual basis.

High streets led the way with a xx% annual increase, followed by retail parks at xx% and shopping centres at xx%.

Shopper sentiment

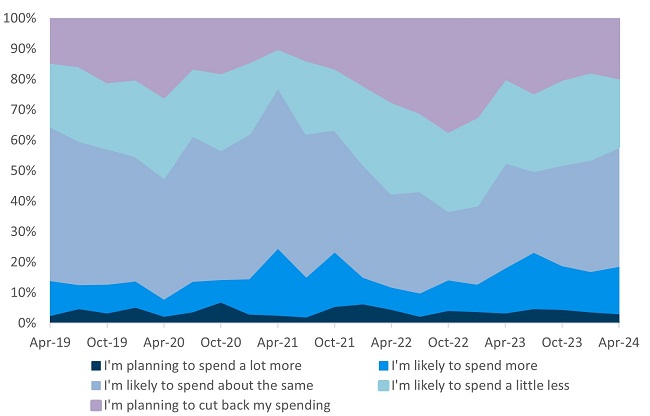

Looking ahead, over half (xx) of consumers said they have some concerns with their personal financial situation in April, up xx percentage points from the start of the year.

Notably, xx% of consumers plan to spend less on non-essential items in the next three months, while xx% expect to spend more.

While there are glimmers of hope among shoppers, many continue to exercise caution in their spending – a trend that has served the health and beauty category well in recent months.

Take out a FREE 30 day membership trial to read the full report.

Spending intentions over the next three months

Source: Retail Economics

Source: Retail Economics