UK Health & Beauty Sector Report summary

April 2022

Period covered: Period covered: 27 February – 02 April 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty sales stepped up in March, rising by 00% YoY, against a 00% rise a year earlier when the country prepared to exit its third national lockdown.

Pre-pandemic comparisons have moved to a three-year basis given the onset of the pandemic is now impacting two-year growth rates. On this basis sales rose by 00% on March 2019, the strongest rise since 00 00.

Increased socialising and office return boosts demand

Demand was supported by increased socialising and a return to offices. Spending data on UK debit and credit cards (based on CHAPS payments) reported a 5% pick up in ‘social’ spending (such as pubs and restaurants) between February and March 2022.

This drove strong performances across a range of beauty items including eye liner, eye shadow and lipstick. Mother’s Day also supported the category while sun care was popular ahead of overseas holidays over the Easter break.

Uncertainty weakens confidence

The cost of living crisis dominated headlines in March, weakening consumer sentiment.

Rising inflation was the top concern for 00 00 (00%) of consumers in April (Retail Economics Shopper Sentiment Survey) accelerating dramatically from the reading at the start of the year (00%).

Affordability concerns also rose higher, with 00% of consumers reporting their cost of living had increased over the last month (ONS, covering period 16-27 March), rising from 83% in the first half of March.

Confidence deteriorated, falling five points to 00 (GfK) in March. Levels of 00 or more are only seen in the lead up to a recession. Confidence has since fallen further in April.

Notably, searches for “recession” reached their highest level since August 2020, rising by 00% YoY in March (Google Trends).

Take out a FREE 30 day membership trial to read the full report.

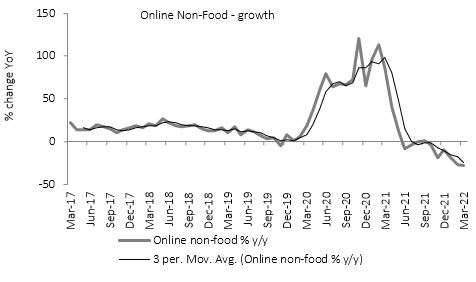

Online Non-Food growth plummets

Source: ONS

Source: ONS