UK Furniture & Flooring Sector Report summary

September 2023

Period covered: Period covered: 30 July – 26 August 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring sales

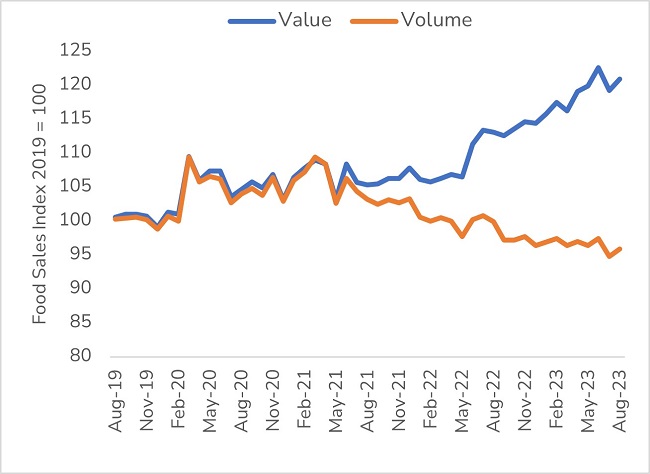

Furniture & Flooring sales increased by xx% YoY in August, according to the Retail Economics Retail Sales Index.

ONS data shows the wider Households Goods category faced xx% YoY shop price inflation in the month, pointing to declining sales volumes.

Sales volumes in the Household Goods category fell by xx% YoY in August (ONS).

Macroeconomic challenges remain

Headline inflation eased to 6.7% YoY in August, the lowest figure since February 2022 (ONS). Core inflation, which remained above expectations in July, fell back below forecasts to 6.2% in August.

The latest data shows earnings growth additionally continued to outplace inflation following 18 months of falling real pay (ONS).

This saw consumer confidence bounce back in August, rising five points to -25, following a sudden six-point fall in July (GfK).

GfK further recorded an eight-point surge in the major purchases index, pointing to improving sentiment to make big-ticket purchases. However, both measures remain firmly in negative territory, with any impact on spending likely to face lags.

Indeed, prices remain significantly higher than before the cost-of-living crisis, while real earnings remain close to zero, far from normal for a measure which grew by 1.7% on average in the year before the pandemic.

In addition, the Bank of England raised interest rates from 5% to 5.25% on 3 August, the fourteenth consecutive increase and the highest since April 2008.

Consumers seek value and familiarity

The summer of 2023 saw furniture & flooring products remained low on households’ priority lists as cost-of-living pressures persisted and discretionary spending was directed at seasonal activities as well as those missed out on during the pandemic such as holidays.

When spending on household goods, consumers opted for smaller and cheaper goods such as budget furniture and homewares.

As a result, Barclays reported transaction growth of 3.2% YoY at Furniture Stores, but still saw spend fall by 2.0% in August.

Combined with high input costs, this saw retailers struggle to protect profitability while continuing to deliver value.

DFS reported that pre-tax profit fell 49.2% to £29.7m in the 52 weeks to 29 June 2023 which the retailer attributed to weak market conditions and high input cost inflation.

Take out a FREE 30 day membership trial to read the full report.

Housing market subdued

Source: RICS

Source: RICS