UK Furniture & Flooring Sector Report summary

March 2024

Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring sales

Furniture & Flooring declines deepened to xx YoY in February, according to the Retail Economics Retail Sales Index.

The category is facing deflation, as input costs ease and retailers attempt to drive growth through value and promotions. The wider Households Goods category faced a xxx xxx in prices in February.

Furniture & Flooring continues to be impacted by a subdued housing market, impacted by supply and affordability as low fixed-rate mortgages expire.

Harsh macroeconomic backdrop

The Household Goods sector is experiencing deflation, highlighted by a price decline in February and January, prompting Ikea to reduce prices on 400 products ahead of Easter.

Despite recent deflation, Household Goods prices remain significantly above pre-pandemic levels, indicating that prolonged deflation is necessary for a return to those levels, yet inflationary pressures are decreasing.

Wages are currently growing faster than inflation, with the lowest inflation rate since xxx recorded in February, and earnings increasing significantly in the months leading to January.

Consumer confidence remains low, affecting spending habits, particularly on big-ticket items, despite a forecasted rebound in real household disposable income to pre-pandemic levels by xxx and a decline in energy prices.

The outlook for consumer spending is cautious due to higher interest rates affecting those renewing mortgages or rents, particularly among younger, middle-income households, despite the Bank of England holding the base rate at a xxx xxx high and the possibility of interest rate cuts later in the year.

Housing market subdued

Furniture & Flooring over the past year has been impacted by a subdued housing market reducing the churn of home moves.

Retail Economics’ analysis of provisional ONS estimates shows property transactions in January were down xx on a year earlier, and down xx compared to average pre-pandemic levels for January (non-seasonally adjusted).

There are early indications buyer interest is improving from lows, however.

Omnichannel oppurtunity

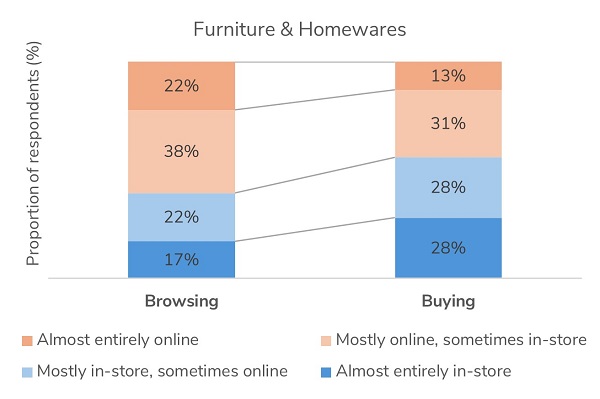

Across non-food, shoppers browse more online than in-store, driven by convenience, breadth and immediacy of online.

However, the transition from online browsing to transaction varies by category. The role of physical stores remains strong at the purchase stage of the customer journey, particularly for infrequent home-related spending.

Here, shoppers tend to educate themselves online, but prefer the certainty of validating purchases in-store to convert into sales.

Take out a FREE 30 day membership trial to read the full report.

Browsing vs. Buying channel preferences

Source: Retail Economics, Auctane

Source: Retail Economics, Auctane