UK Furniture & Flooring Sector Report summary

July 2022

Period covered: Period covered: 29 May – 02 July 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring remained in decline on an annual basis in June, with sales down by 00% against a strong 00% rise a year earlier.

Although Covid restrictions which turned household’s attention indoors have been lifted, home-life remains critical as hybrid working takes hold.

But the composition of sales is changing, given the cyclical and infrequent nature of big ticket purchases and the pressure on personal finances as inflation takes off. For instance, bed sales have reportedly slowed, with signs of price sensitivity as household goods inflation remains at double-digits – up by 00% in June.

Real earnings falling as services recover

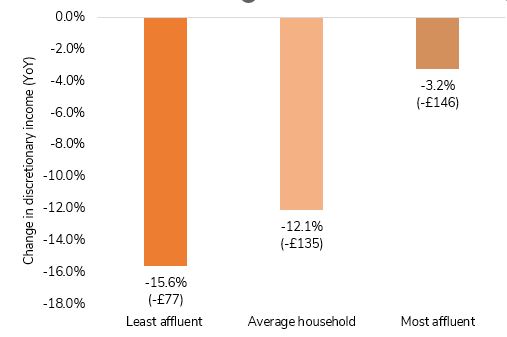

Inflation across the wider consumer basket hit a 40-year high of 9.4% in June, leaving the typical family with around £135 less cash per month to spend on non-essential purchases, according to the Retail Economics-HyperJar Cost of Living Tracker.

This has put consumer confidence at a record low. The major purchases index, which measures willingness to spend on big ticket items, is 00 points lower than a year ago at a firmly negative -00 in July according to GfK.

But rising living costs do not impact households equally. Rising food, utility and commuting costs disproportionately burden the least affluent households, who are already facing double-digit rises in the price of goods and services they buy.

Housing softening but resilient

The level of transactions in the housing market, which is intrinsically linked to Furniture & Flooring purchases, has also softened to around 00 sales in June – less than half the rate a year earlier when movers looked to complete purchases ahead of changes to the stamp duty holiday.

Nonetheless, the market is likely to continue to provide some support for the category, with recent transaction levels broadly in line with pre-pandemic averages.

The housing market continues to show a shift in demand towards bigger properties, with room for hybrid working and outside space. It’s seen average prices for detached houses rising by almost twice the rate of flats over the past year at 00% compared with 00% respectively.

This is being driven by higher earners who have been able to use extra savings accumulated during the pandemic to fund purchases. By contrast, lower earners most under pressure from falling discretionary incomes are less likely to be homeowners or actively looking to buy.

Supply issues

Supply issues are constraining and delaying sales. Labourers have been scarce (across manufacturing, haulage and tradesmen) and key shipping ports around manufacturing hubs have been backlogged since the pandemic. This has been a particular issue for Furniture retailers that are less able to divert goods through alternatives such as air freight, due to the size and nature of products.

This is putting retail operations under pressure. Furniture etailer Made.com is facing a £20m headwind on the back of disruptions at ports and warehouses, leading to increased promotional activity to clear delayed and excess inventory.

Take out a FREE 30 day membership trial to read the full report.

Households seeing double-digit declines in discretionary income

Source: Retail Economics-HyperJar cost of Living Tracker

Source: Retail Economics-HyperJar cost of Living Tracker