UK Furniture & Flooring Sector Report summary

February 2022

Period covered: Period covered: 02 January – 29 January 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring Sales

Furniture & Flooring sales rose by a staggering 00% in January year-on-year, according to the Retail Economics Retail Sales Index. This was the strongest yearly performance for the category since May 2021.

Sales levels however came short on January 2020’s pre-pandemic levels, down 00% for the month. But this could be an early sign that consumer spending is returning to more traditional patterns seen before Covid, as January was typically the peak period for Furniture sales.

Elsewhere, spending levels for this category for the month contracted on the previous month by 00%. This comes as no surprise given that, from 5 January 2021, the UK entered its third national lockdown with no clear road map out.

Further, GfK’s consumer confidence went as low at 00 in January 2021, with the major purchases index at 00 in the same month. All of which had an adverse effect on furniture sales in January 2021, thus providing weak comparable for this month’s performance.

Lastly, another contributing factor to this stellar growth was the arrival of a considerable amount of stock for retailers that had been delayed up till now. Enabling most furniture retailers to fulfil many of their orders.

Falling concerns about Omicron fosters outdoor retail activities

The UK continued to unwind restrictions in January. In addition, the government began taking the stance of learning to ‘live with Covid’, which from 27 January saw an end to: work-from-home guidance, face coverings in public places and Covid passports.

Most high streets and retail parks are expected to operate with little or no restrictions henceforth.

In-store furniture sales on the other hand, returned to growth for the first time in ...

Despite the easing of lockdown and the re-opening of shops, the penetration rate for household goods stood at 00% for the month (Retail Economics). Thereby highlighting consumer convenience for using online retail for making even major purchases since the pandemic hit.

Challenging Macro Environment

Rising inflation fuelled by higher production costs, higher energy and transportation costs, means that consumers will have to tighten their belts as we head into the spring season. On 20 January, inflation hit a 30-year high at 5.4% in December, and it’s since stepped up again in January to 00%.

A recent survey by the ONS revealed that two-thirds (00%) of consumers saw a rise in their cost of living over the last month, with food shop prices (00%), gas & electricity (00%) and fuel prices (00%) being the main drivers.

Real earnings are expected to be squeezed further, and the poorest households will be hit hardest as they spend more than 00% of their average weekly expenditure (£00) on essentials. The Bank of England warned that inflation could tip more than 00% in the coming months which would be far ahead of wage increases.

GfK consumer confidence index fell 00 points to 00 in January. All five indicators of the index softened with the major purchases index falling by 00 points to 00. Clearly, consumers are worried about rising costs of living and possible interest rate hikes.

As the economy unwinds, retailers are expected to face stiff competition from other spending opportunities as the public diverts their spending on social and leisure activities like restaurants, cafes, life events, etc.

There is still a significant amount of pressure in the supply chain despite evidence of easing in December. Input producer price inflation accelerated by 00% YoY while factory gate (output prices) inflation rose by 00%, from...

Housing market activities picks-up

UK house prices rose 00% YoY in January (Halifax). House prices remained c. £24,500 up on January last year, and £37,500 higher than January 2020.

The RICS UK Residential Survey for January shows buyer enquiries picked up over the month, with a net balance of 00% of agents noting a rise (up from 00% in Dec). This is the strongest figure for enquiries since May 2021.

A net share of 00% of agents foresee sales volumes increasing over the next three months (up from 00% in December).

However, house price rises continue to surpass earnings growth and, affordability remains an obstacle for many. For example, a 10% deposit on a typical first-time buyer home is now equivalent to 00% of total gross annual earnings, a record high.

Take out a FREE 30 day membership trial to read the full report.

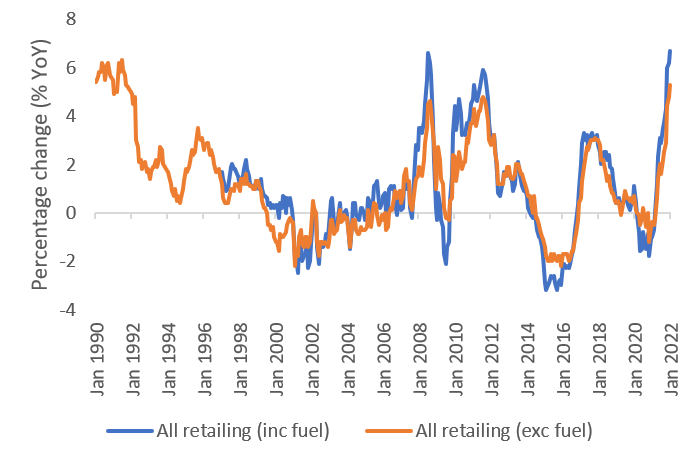

Retail inflation at its highest rate in 30 years

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis