UK Food & Grocery Sector Report summary

September 2021

Period covered: Period covered: 01 – 28 August 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food sales growth rose by 00% YoY against a 5.1% rise a year earlier. Against 2019 levels, Food sales rose by 5.2%.

August was the first full month of no Covid-19 restrictions, giving consumers a sense of normality.

Consumers are already feeling the pressure on their household budgets with 00% of respondents noticing a rise in the amount spent on their weekly household food shop (Retail Economics Consumer panel, September).

Retailers supply chains continued to be disrupted in August, however. Ongoing shortages of labour (particularly fruit and veg pickers, meat processors and HGV drivers) led to supply constraints.

Resultantly, a third of consumers faced difficulty in getting the goods they needed (Retail Economics Consumer panel).

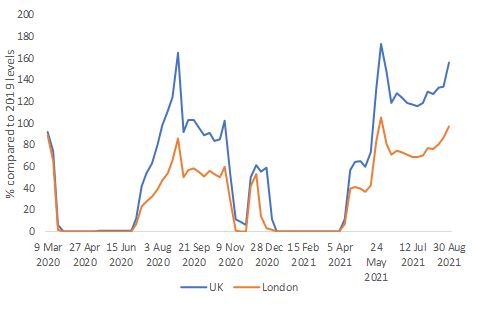

Instead, consumers frequented hospitality venues with like-for-like sales at restaurants up 00% in August versus the same month in 2019.

Retailers’ ability to absorb rising cost pressures became unsustainable in August with food inflation creeping into positive territory for the first time in 10 months (+00%, YoY).

Further supply disruption is expected as we head into the golden quarter. Retailers have warned that unless temporary measures are put in place to hire more HGV drivers, empty shelves will be a regular occurrence in the lead up to Christmas.

One Tesco executive warned, “Our concern is that the pictures of empty shelves will get ten times worse by Christmas and then we’ll get panic-buying,”

Convenience was in order with sales of chilled ready meals rising by 11% (Kantar, 12 weeks to 5 September) as appetites for home cooked meals dwindled.

To try and alleviate some of the pressure, Tesco deployed its ‘Stock up Early’ initiative, encouraging shoppers to buy Christmas staples now to avoid potential disappointment later on.

Take out a FREE 30 day membership trial to read the full report.

Seated diners, seven-day average, percentage compared with the equivalent week of 2019

Source: Open Table

Source: Open Table