UK Food & Grocery Sector Report summary

October 2021

Period covered: Period covered: 29 August – 2 October 2021

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food sales growth fell by 0.5% YoY against a 0.00% rise a year earlier. Against 2019 levels, Food sales rose by 0.00%.

September was anticipated as a step towards ‘normality’ with workers returning to offices and children returning to schools at the end of the summer holidays.

Data from TfL showed that Monday 6 September was the busiest Monday ‘rush hour’ since the start of the pandemic with 831,000 taps on London’s tube network between 7am and 10am. Contextually, this is around half the level seen prior to the pandemic.

However, pressure piled on consumers as the month progressed, derailing spending.

Adding to the ongoing supply chain disruptions from a shortage of HGV drivers, consumers were hit in very quick succession with a national shortage of carbon dioxide (used in the production of food) and fuel in the second half of the month.

Surging energy prices resulted in the closure of two fertiliser plants that supplies 60% of the UK’s commercial carbon dioxide on 16 September.

A stark warning on 20 September by retailers and suppliers that supermarkets would run out of food ‘by the end of next week’ saw the government hastily broker a deal the following day with the CO2 producer to restart production in the hope of alleviating fears of food shortages.

Whilst there was little evidence of panic buying, around 1 in 6 (17%) adults reported that they had not been able to buy essential food items because they were not available in the final two weeks of the period (ONS).

When food shopping, 0.00% of adults noted experiencing differences compared to usual times with ‘less product variety’ cited as the most common issue (ONS).

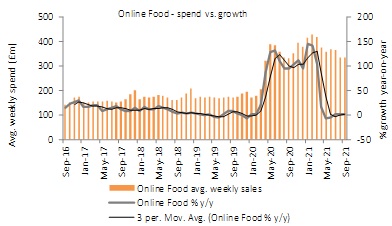

Online food sales growth rose by 0.00% YoY – its best performance since June. Improved trust in online shopping since the onset of the pandemic has allowed consumers to seamlessly transition between channels to suit their buying needs.

Take out a free 30 day membership trial to read the full report

Online channel boosted as shoppers stay away from stores

Source: ONS

Source: ONS