UK Food & Grocery Sector Report summary

May 2024

Period covered: Period covered: 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales fell xx% YoY in April, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key factors impacted this performance:

Timing of Easter: An Early Easter meant preparations were brought forward into March this year, as opposed to April in previous years, artificially boosting March’s sales this year, and negatively impacting Food sales in April.

Lower Inflation: Easing food inflation, compared to double-digit price rises a year ago, is leading to tough annual comparisons for Food sales in value terms.

Adverse weather: Unsettled, wet, and windy weather resulted in the wettest April since 2012, reducing footfall and supporting online sales. More meals were consumed at home as consumers avoided venturing out to restaurants and bars. Like-for-like sales in hospitality venues fell by xx% YoY in April, down from xx% growth in March (CGA-RSM).

Easter distortions

Food sales fell into decline for the first time in over two years (March 2022), reflecting the severity of the Easter distortion as Easter is a major event in the culinary calendar.

With Easter falling in March this year, the UK grocery market inevitably faced challenging year-on-year comparisons in April. As anticipated, both sales and volumes declined when compared to the same time last year.

However, analysing spending over a two-month period across March and April provides a more robust picture of underlying demand during a comparable Easter trading period to last year.

Using this measure shows Food & Grocery sales growth of xx% YoY across Mar-Apr, compared to a xx% decline across Non-Food.

Confidence improving

On the upside, there’s been improvement in earnings. Real pay is growing at the fastest rate in two years (up xx% in the first quarter), and minimum wages went up to over £11 per hour – the equivalent to two-thirds of median earnings, giving the UK one of the highest wage floors.

On top of this, National Insurance Contributions (NIC) were reduced further in April, following January’s cut.

Lower inflation coupled with NIC cuts has fed into improving confidence. The consumer confidence index rose for the second consecutive month in May, up two points from April to xx (GfK - An NIQ Company).

Despite this, there is significant ground to recover. The index for big-ticket purchases remains negative at xx, while the index for savings is strong at xx.

Prices are still ultimately significantly higher compared to recent years, and households have become skilled at budgeting, prioritising saving or debt repayment. A sustained period of real earnings growth is necessary to boost financial sentiment and spending intentions.

Take out a FREE 30 day membership trial to read the full report.

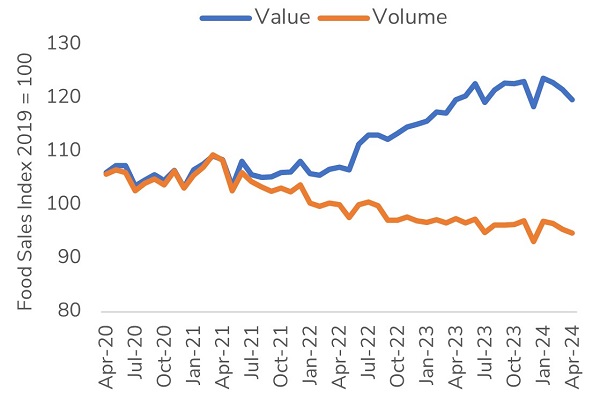

Food retail sales values and volumes diverge

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted