UK Food & Grocery Sector Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xxYoY in February, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Food & Grocery sales remained robust in February, outperforming the wider retail sector once again (Food: xx, Non-Food: xx).

Key factors impacted this performance:

Poor weather: The South of England experienced its wettest February on record, with much of the region recording more than twice the average rainfall, urging customers to spend more time indoors.

Televised events: Key televised events such as the Super Bowl and Six Nations rugby as well as popular releases on streaming platforms encouraged consumption of meals at home.

Valentine’s at home: February saw those celebrating Valentine’s day choose to do so at home rather than splashing out on restaurants and other forms of entertainment, encouraging relevant grocery purchases.

Promotions: Retailers continued to engage in competitive promotional and price-matching activity in February, driving up spending on

Solid start to 2024

A combination of unseasonably wet weather, several key televised events, subdued restaurant attendance, and intense retailer competition for promotions encouraged spending on food and grocery products.

Food and non-alcoholic beverages inflation rose by xx YoY in February, down from 6.9% in the previous month.

This marked the xxxx rate since xxx xxx, with downward pressure coming predominantly from the bread and cereals category, with smaller downward contributions from xxx, xxx, and xxx, xxx and xxx.

Food prices have remained relatively stable since the beginning of the summer, rising by less than xx in the xxx months to February 2024, compared with a sharp rise of xx in the xxx months to May 2023.

Wage growth remains strong and continues to surpass inflation, leading to regular and total pay increasing by 1.8% and 1.4% respectively in real terms in November 2023 to January 2024.

Despite a gradually improving macroeconomic backdrop, consumer confidence fell by two points to xx in February 2024, according to GfK, although all measures remained xxx than a year ago.

The measure remained unchanged at -21 in March, with consumers largely uncertain about the onward trajectory of their respective financial situations in the year ahead.

While months of more stable prices have regulated demand for staples, consumers’ appetite for discretionary food products depends closely on their prioritisation of other areas.

Take out a FREE 30 day membership trial to read the full report.

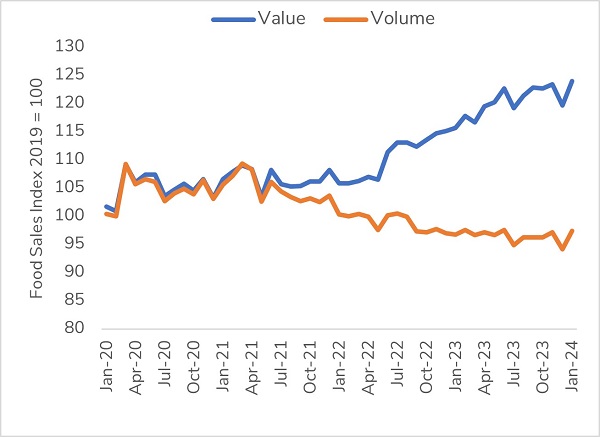

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS