UK Food & Grocery Sector Report summary

February 2024

Period covered: Period covered: 31 December 2023 – 27 January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose 6.5% YoY in January, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key factors impacted this performance:

Cautious consumers: January saw a renewed focus on budgets after indulging over the festive period. Cost-conscious shoppers cut back on basket sizes, prioritising warming winter meals, and avoiding waste —a nod to the need to pay off Christmas credit card bills and offset higher energy costs.

Inclement weather: January's trio of storms: Henk, Isha, and Jocelyn – dragged on in-store footfall but boosted online activity, while the severe weather encouraged more at-home meal occasions, with hospitality venues experiencing flat sales in January (0.1% YoY, CGA-RSM) as consumers stayed indoors.

New Year’s Eve: This year’s January trading period (Dec 31-Jan 27) included New Year’s Eve, boosting sales of party food and refreshments, as the bad weather led many people to celebrate at home.

Health-conscious resolutions: The advent of the New Year propelled health-focused initiatives such as Dry January and Veganuary, supporting demand for No-Lo alcohol drinks and plant-based products.

Solid start to 2024

Food & Grocery performed robustly in January, outperforming the wider retail sector once again (Food: 6.5%, Non-Food: -0.7%).

Poor weather, rail strikes and the usual post-festive caution in spending habits resulted in more time (and meals) at home.

Encouragingly, Food inflation remains on a downward trajectory, easing to 6.9%, from 8.0% in December - the lowest level since April 2022.

Notably, monthly food prices fell for the first time since September 2021, down 0.4% in January, which was the largest monthly fall since July 2021.

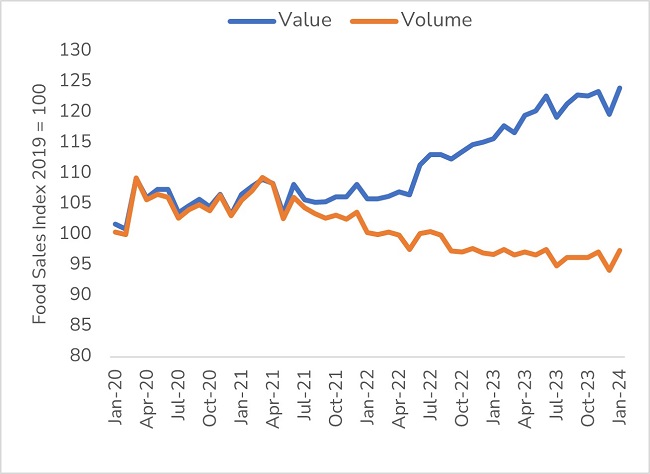

Despite lower inflation, the headline rate of growth in grocery sales was relatively stable in January compared to December, indicating a significant uptick in grocery sales volumes.

However, this must be put in context, as the market has endured a prolonged period of deep volume declines, and the economic backdrop remains mixed.

Households and businesses are feeling the impact of higher interest rates, tipping the economy into a shallow recession.

While an increase to the Ofgem energy price cap at the start of the year saw the typical annual household energy bill go up by 5% or £94 to £1,928. It contributed to overall inflation remaining unchanged at 4.0% (ONS) – double the Bank of England’s 2% target.

On the earnings front, there was a silver lining as average wage growth continues to surpass inflation. Although the peak wage growth rate of 8.6% in mid-2023 has decelerated to 6.2%, wages are still outpacing the slowing rate of inflation, driving real earnings.

On the back of this, consumer confidence improved in January, reaching its highest level in two years at -19 (GfK).

Take out a FREE 30 day membership trial to read the full report.

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS