UK Food & Grocery Sector Report summary

August 2023

Period covered: Period covered: 02 – 29 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xx% YoY in July, the weakest growth rate since October, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key factors impacted this performance:

July washout: Unseasonably wet weather – July was the xxxx wettest since records began in xxxx – led consumers to stay indoors, dampening demand for BBQ food and summer lines, especially compared to last July when a heatwave saw the hottest day ever recorded in the UK.

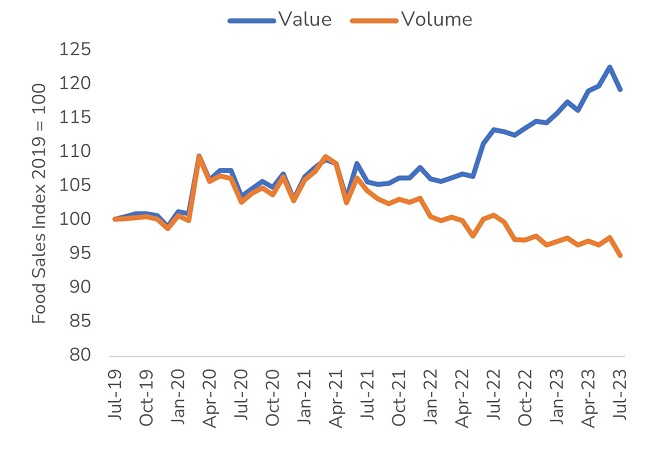

Inflation: Although moderating, food inflation remains historically high. This is lifting sales in value terms, but dragging down volumes, as consumers pay closer attention to budgets and reduce basket sizes. In volume terms, Food & Grocery sales fell xx% YoY in July.

Downpours dash hopes of volume recovery

Food inflation is on a decelerating trajectory, easing to xx% in July, down xx percentage points on the previous month (CPI). The retail price deflator for food stores, a specialist measure of retail-specific inflation, also fell from xx% to xx%.

Reduced prices of essentials such as milk, bread and breakfast cereals contributed to the lower rate of food inflation, as retailers launch strategic price cuts across staple items.

However, the absence of summer weather dashed hopes that lower inflation would help to spur a recovery in sales volumes.

The weakness in Food sales volumes deepened in July, down xx% YoY, according to Retail Economics estimates (compared to average of xx% in Q2 2023).

Volume sales of ice creams were down xx%, while soft drinks sales were nearly a fifth lower than 12 months ago. Instead of the usual summer fare, consumers turned to more traditional winter warmers. The amount of soup bought was up by xx% YoY, while roasting joints grew by xx% (Kantar).

The inclement weather discouraged shopping trips, leading to the first decline in footfall in 18 months, with 320,000 fewer visits to supermarkets compared to the prior year.

Online benefited as a result. Online accounted for xx% of total Food sales July, the same proportion as last year. This marks the first time since 2021 that online penetration has not come in lower than a year earlier.

Take out a FREE 30 day membership trial to read the full report.

Food retail sales values and volumes diverge

Source: Retail Economics, ONS

Source: Retail Economics, ONS