UK Food & Grocery Sector Report summary

April 2025

Period covered: Period covered: 02 March – 05 April 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose by a weak xx% year-on-year in March, against xx% growth a year earlier, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Several factors impacted this performance:

Easter distortion: March 2025 lacked the Easter boost that benefited last year’s sales. With Easter falling in April this year, seasonal uplifts in categories like confectionery, alcohol and meat were deferred, skewing year-on-year comparisons and dampening overall grocery growth.

Promotions prioritised: Promotional activity hit a four-year high for March, with xx% of grocery sales made on deal (Kantar). Member pricing and loyalty-linked discounts remained critical in retaining shoppers, who visited just under five retailers on average — the lowest level since 2021.

Cautious spending: Despite inflation outpacing earnings, volumes were subdued as budget consciousness across essentials remains high, reinforcing demand for value-led products and own-label.

Multiple sources track UK Food & Grocery sales, each using different methodologies, sample sizes, and reporting periods. Retail Economics provides a consolidated view by aggregating data from key sources, supported by panel insights (see here for more).

Easter impact

The modest xx% YoY growth in March marks a significant slowdown compared to prior months.

This deceleration was largely driven by a calendar distortion, as Easter — a key driver of seasonal grocery spending — shifted into April this year, removing a critical sales catalyst from March comparatives. In contrast, March 2024 had benefited from early Easter trading, inflating last year’s growth baseline.

The absence of Easter-related demand was most evident in categories such as confectionery, where sales fell xx% YoY (NielsenIQ), alongside declines in premium meats, alcohol, and bakery items traditionally associated with festive dining. Retailers were left relying on core grocery sales and tactical promotions to drive footfall and basket value.

Loyalty beyond price

For Asda, the challenge is clear: while aggressive pricing may win short-term traffic, long-term success will hinge on improving store experience, product availability, and brand trust. Recent consumer trends suggest that while shoppers readily switch for better deals, true loyalty is earned through a blend of value, quality, and service consistency.

Retailers such as Marks & Spencer demonstrate this well, maintaining premium positioning while selectively deploying promotions to support volume growth, as seen in their successful dine-in campaigns.

For full-line grocers like Tesco, Sainsbury’s, and M&S, the strategy is not to match Asda cut-for-cut. Their broader customer base values a combination of convenience, quality, and trust. The focus must remain on strategic, targeted promotions, enhancing private-label offerings, and reinforcing brand differentiation.

Ultimately, grocers that balance value-led innovation, intelligent discounting, and margin management will emerge strongest.

The competitive battleground has shifted, where it’s no longer about who cuts the deepest, but who discounts the smartest.

Take out a FREE 30 day membership trial to read the full report.

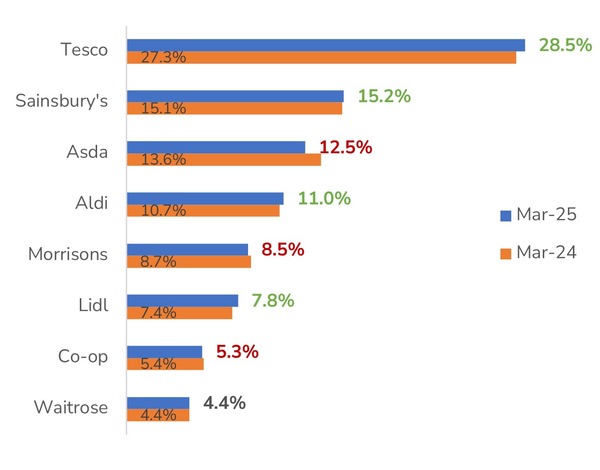

UK Grocery Market Share (12 weeks to 23 March)

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics