UK Food & Grocery Sector Report summary

April 2022

Period covered: Period covered: 27 February – 02 April 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales fell 00% YoY in March, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted). Against March 2019’s pre-pandemic levels, Food sales were up by 00%.

Easter plays a significant role in the pattern of Food sales, as in the run-up to the event sales increase sharply as people prepare to meet with friends and family. Easter occurred earlier last year, boosting March’s sales figures, but the later timing of Easter this year means March 2022 sales are depressed in comparison.

Consumers are also resorting to more savvy shopping behaviours as inflationary pressures intensify. For example, reducing basket sizes, cutting back on premium products, and shopping more often at discounters.

Online performance

Online food sales experienced a sixth month of decline, down 00% in March, compared with the previous year when lockdown saw sales more than double.

Average weekly spending for Online Food was £00 in March, compared to £412m per week twelve months earlier.

While shoppers are shrugging off their pandemic habits and returning to stores, the proportion of online sales remains elevated, at 00% of total Food sales in March, compared to 5.6% pre-pandemic.

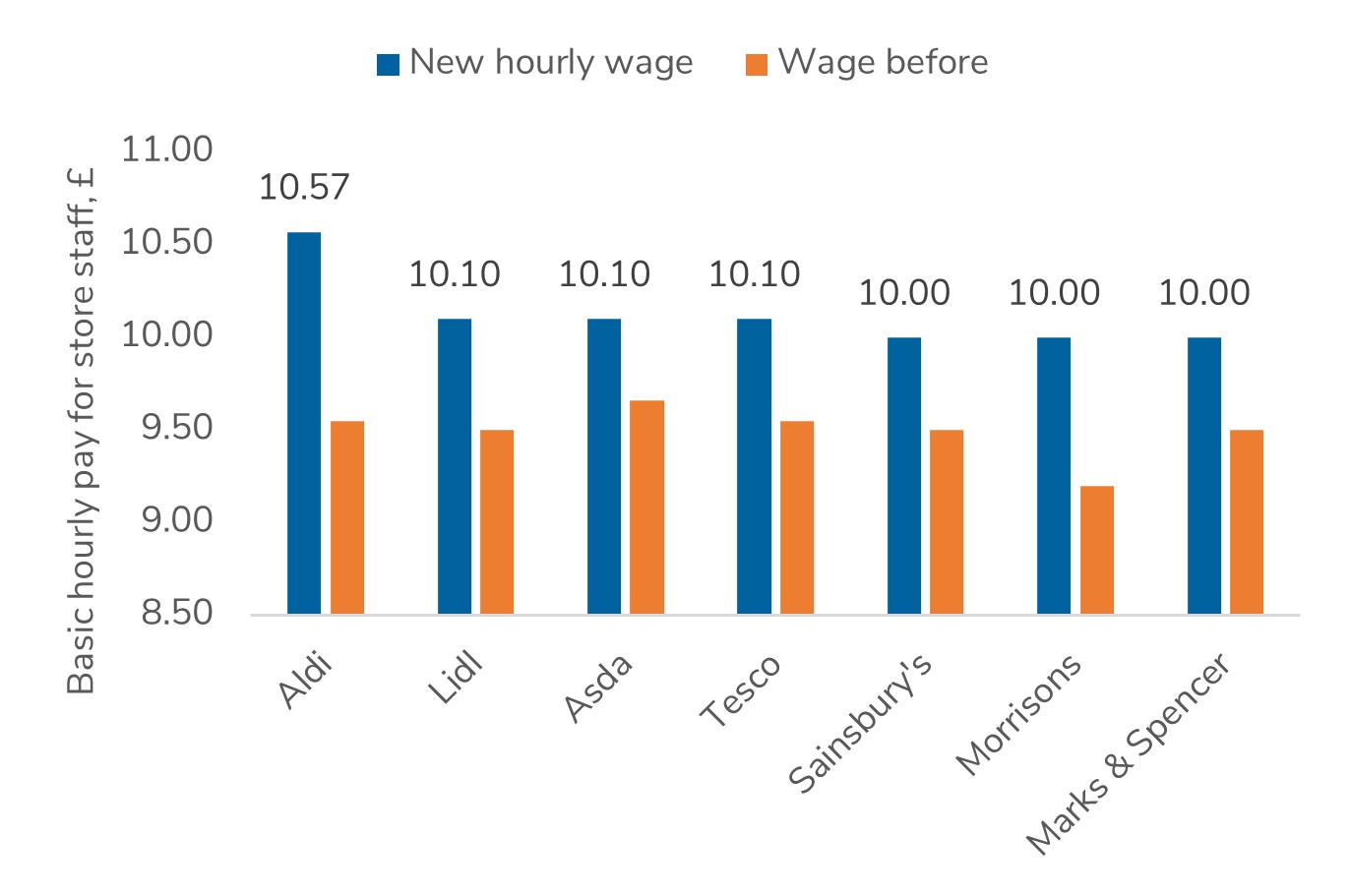

Labour costs on the up

From the range of cost pressures racking up for the Food sector, one of the most persistent and intense is wages, as retailers compete for staff in a tight labour market.

There were 108,000 unfilled vacancies in retail in the first quarter of this year — the highest in more than two decades (ONS).

All major UK grocers now increased their basic hourly pay rates ≥ £10, above the statutory minimum wage of £9.50 and the voluntary “UK real living wage”.

Sector outlook

Retail Economics forecasts Food & Grocery sales to moderate over 2022, dipping by 00% YoY, with total annual sales projected to register £00.

Consumer spending will rebalance in favour of restaurants and hospitality, reflecting less working-from-home and strong pent-up demand for socialising.

Take out a FREE 30 day membership trial to read the full report.

Supermarkets increase their pay rates to attract staff

Source: Retail Economics

Source: Retail Economics