UK Electricals Sector Report summary

September 2023

Period covered: Period covered: 30 July – 26 August 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales fell xx% YoY in August, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a xx% decline a year ago.

Inflationary pressures within the sector eased In August with a basket of Electricals rising by c.xx%, supporting top line growth. However, volumes remain firmly in negative territory as consumers focus spending elsewhere.

Soft demand

Overall retail sales improved in August following July’s disappointing performance supported by unpredictable weather, discounting and feel-good events.

However, there was no such boost for the Electricals category which continues to bear the brunt of ongoing pressure on household budgets with sales now in decline for the xx consecutive month.

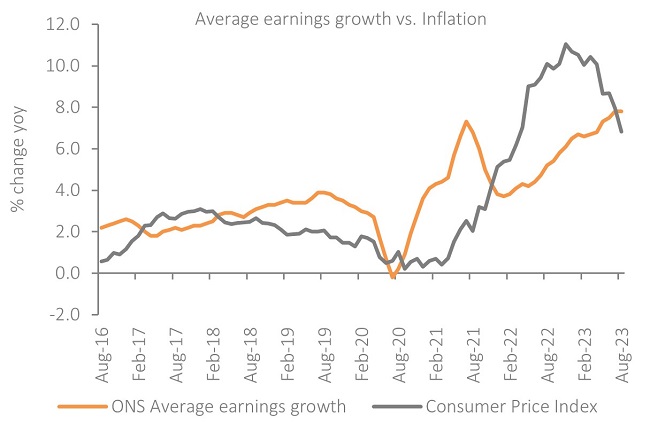

This was despite the latest earnings growth data outpacing headline inflation for the second consecutive month following a year and a half of real annual regular pay declines.

Consumer confidence bounced back as a result, rising five points to -25 in August with greater optimism about personal finances and making major purchases.

The Bank of England paused interest rates at 5.25% in September, raising hopes that a peak in borrowing costs has been reached after fourteen consecutive hikes.

However, consumer spending remains cautious, with non-essential spending focussed on areas outside of retail which were previously missed out on due to pandemic disruptions.

Airline (+32.1%) and travel agents (+3.7%) spend remained in growth, according to Barclaycard data.

A fifth of consumers indicated that spending on luxury items/experiences was a priority for them with holidays abroad and hotel stays coming out as top purchases to focus on (Barclaycard).

Sales fall

In its recent trading update, Currys reported a 2% fall in UK & Ireland like-for-like sales (17 weeks to August 26).

Encouragingly, it noted revenue trends had improved in July and August compared to the previous two months supported by an uptick in performance in domestic appliances and mobile.

This resonates with reports from Marks Electrical which saw demand for domestic appliances surge in its first quarter.

Currys said that part of its improved performance was offset by weakness in other categories like computing that saw strong growth during the pandemic as consumers worked from home.

A greater number of people now working more days in the office is likely to have a negative impact on future growth prospects within this segment.

Take out a FREE 30 day membership trial to read the full report.

Real earnings turn positive as inflation cools

Source: ONS

Source: ONS