UK Electricals Sector Report summary

March 2021

Period covered: Period covered: 31 January – 27 February 2021

Note: Reporting periods are either one or two months behind the current month as standard reporting practice. Certain figures are not shown. Take out a free 30 day subscription trial to access this data or subscribe.

Electricals sales continue to defy the impact of lockdown, increasing by 00.00% year-on-year in February.

Online Electricals sales maintained staggering levels of growth in February, up 158.5% year-on-year, according to IMRG.

Increased working and learning from home boosted demand for laptops and tablets in February, as has been the case in previous lockdowns. Home entertainment was also high on the agenda for consumers.

The UK remained in a national lockdown in February, with restrictions on social interaction, schools closed and work from home policies in force.

As a result, total retail sales fell by 00.00% year-on-year in February, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel).

The closure of non-essential stores throughout February led to sharp polarisation in performance between food (+10.2%) and non-food sectors (-11.1%).

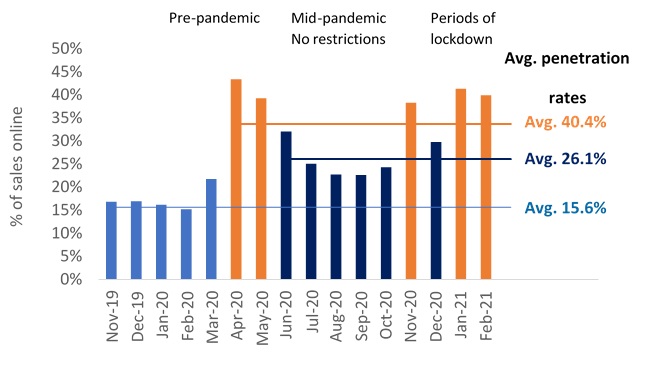

For non-food retail, the proportion of online sales has risen markedly on pre-pandemic levels, up from 15.6% in the 12 months to March 2020 to 40.4% during months of lockdown (Fig 1). Even when shops reopened (mid-pandemic), the proportion of online sales for non-food remained at elevated levels, averaging 26.1% during these months.

It is worth noting that even prior to the pandemic, more Electricals sales took place online than in-store. Electricals had an online penetration rate of nearly 60% in 2019 – considerably higher than any other retail sector.

Electricals is therefore better adapted to the closure of physical stores as it benefits from greater online capacity and consumer experience of shopping online for electrical products.

The strong sales performance during lockdown is testament to this, as many consumers showed they are able to seamlessly revert to online channels for electricals purchases.

Online Electricals sales maintained staggering levels of growth in February, up 158.5% year-on-year, according to IMRG.

Lockdown is encouraging many consumers to purchase luxury household appliances that make home life more comfortable and convenient (e.g. coffee machines, kitchen aids).

Increased working and learning from home boosted demand for laptops and tablets in February, as has been the case in previous lockdowns.

Stock availability remains a challenge for some electricals products (e.g. TVs, games consoles) due to a combination of high demand and supply chain issues.

Against the backdrop of tougher competition, narrower profit margins and rising levels of returns, some retailers (particularly legacy retailers with expansive store estates) will struggle to compete with more specialised online players.

Even those retailers with well-established online propositions will need to cut costs and pivot their business models towards a digital-first customer journey fast.

Take out a free 30 day trial subscription to access the full report >

Fig.1 - Comparison of online penetration rates for Non-Food before the pandemic, during lockdown and mid-pandemic during periods of fewer restrictions

Source: ONS

Source: ONS