UK Electricals Sector Report summary

July 2023

Period covered: Period covered: 28 May – 1 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales fell 00% YoY in June, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a 00% decline a year ago.

The decline was broadly in line with last month’s performance and was marginally weaker than the three-month average of 00%.

Inflationary pressures within the sector continued on a downward trajectory in June, with a basket of Electricals rising by c.00%, supporting top line growth. This suggests that volume growth remains firmly in negative territory.

Demand struggles

Households remain price sensitive. This is leading to hesitancy in spending within the sector and more considered purchases.

But consumers are responsive to certain triggers that entice dipping into savings and recent earnings growth.

Electricals, which remained at the bottom of growth rankings table, continues to face a cyclical slump in demand, although record temperatures in June drove strong demand for air-conditioning units mid-month.

However, higher value items continued to face latent demand amid squeezed household budgets.

Curry’s reported revenues fell 6% for the year to £9.51bn, with all markets seeing a decline except Greece, which the retailer attributed to widespread cost-of-living pressures.

Economic backdrop

The economic backdrop remains challenging for households with ongoing fears of a wage-price spiral.

While annual inflation fell back to the better-than-expected rate of 7.9% in June, it remains significantly ahead of the Bank of England’s 2.0% target rate.

The Bank responded to ongoing inflationary pressures by raising interest rates by 50 basis points to 5.0%, marking the 13th consecutive hike and the highest rate in 15 years.

Average mortgage rates were pushed above 6% as a result, heaping pressure on households that are set to refinance in the next year.

Electricals outlook

Electricals is set to be the worst performing retail sector in 2023. Retail Economics forecasts Electricals sales to drop 00% YoY in 2023, with total annual sales set to register £00bn, down from £00bn in 2022.

Electricals is a highly price-sensitive sector, with rising prices leading many shoppers to defer purchases, given the current squeeze on incomes and weak consumer confidence.

Electricals has the highest online penetration rate of any retail sector, projected at 00% of total sales in 2023.

Take out a FREE 30 day membership trial to read the full report.

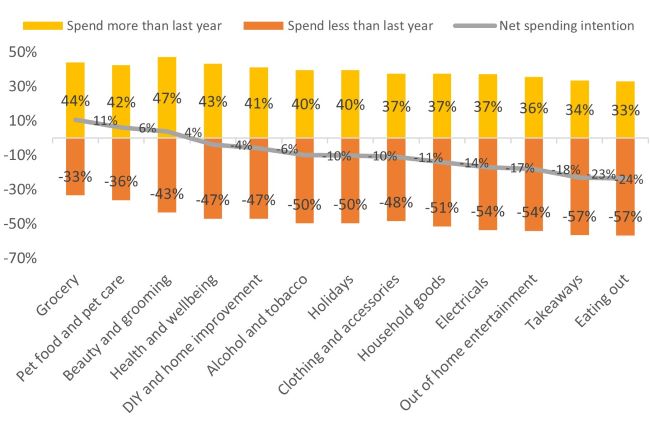

Consumer spending intentions by category: How do you intend to spend on the following categories this financial year (to April 2024)?

Source: Retail Economics, Grant Thornton

Source: Retail Economics, Grant Thornton