UK Electricals Sector Report summary

August 2023

Period covered: Period covered: 02 – 29 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales fell xx% YoY in July, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a xx% decline a year ago.

The erosion of household budgets amid surging levels of inflation is seeing consumers prioritise retail cut backs across categories that faced high spending during lockdowns.

Inflationary pressures within the sector were broadly unchanged from the previous month in July with a basket of Electricals rising by c.xx%, supporting top line growth. But volume growth remains firmly in decline.

Demand falters

Hesitancy to splash out is seeing consumers delay spending until budgets look healthier.

A brief warm spell in early July was the only bright spot in a largely dull and wet month. Average rainfall was significantly ahead of July norms making it the sixth wettest July on record and the wettest July for 14 years.

Temperatures were below the average for July resulting in weak demand for items such as fans and air conditioning units which would typically be popular.

This was a far cry from the record temperatures experienced last July with some days reaching 40C leading to a surge in air conditioning units.

Spending rises elsewhere

We continue to see sectors outside of retail perform strongly.

Data from Barclaycard showed that spending within the entertainment segment rose by 15.8% YoY in July, supported by purchases of concert tickets for headline acts including Taylor Swift.

Travel spending also remained elevated with spending on Airlines up 39.1%, Travel Agents up 7.8% and Hotels, Resorts and Accommodation rising by 5.6%.

Harsh macro backdrop

The Bank of England’s 13th consecutive rise in the official Bank Rate towards the end of June saw a surge in mortgage rates in the second week of July to their highest level since xxxx.

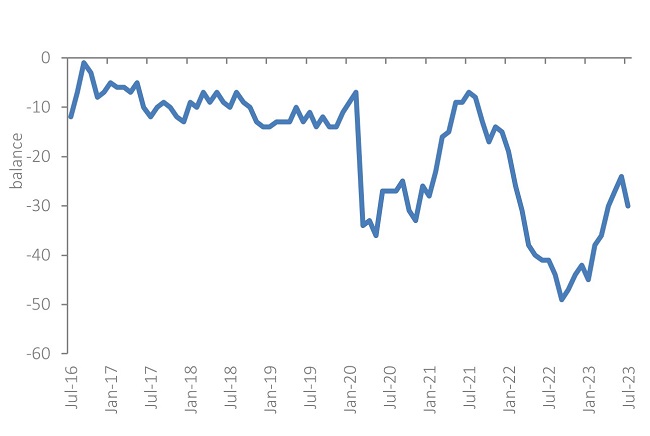

Prospects of higher mortgage rates (and repayments) for those consumers refinancing in the next year led to consumer confidence plunging six points to -30 in July (GfK).

GfK’s major purchases index also fell back, down seven points to -31 in July, suggesting there’s currently little prospect of spending improving for large electricals items.

Our own consumer panel shows that xx% of consumers were a little concerned with their personal financial situation in July, up from xx% in April (Retail Economics Shopper Sentiment Survey).

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence fell by six points in July

Source: GfK

Source: GfK