UK Electricals Sector Report summary

April 2025

Period covered: Period covered: 02 March – 05 April 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals continued to outperform other retail categories in March, with sales rising xx% year-on-year. This marks a sharp rebound from the xx% decline recorded in the same month last year.

Growth was supported by seasonal refresh activity, spring promotions, and resilient demand for home tech and small appliances.

Retailers benefited from improved consumer confidence and a clearer replacement cycle dynamic, particularly for goods first purchased during the pandemic. Kitchen appliances, home entertainment, and personal electronics were notable growth areas.

Several retailers reported strong demand for smaller kitchen tech, grooming products, and mobile accessories, aided by discounting and new product launches.

Key trading themes and drivers

- A combination of seasonal and behavioural factors reinforced March's strong results. The shift to warmer, drier weather helped drive a natural pick-up in home improvement and tech refresh activity.

- Consumers took the opportunity to upgrade personal and home electronics ahead of the Easter break, with increased interest in products linked to hosting, cooking, and entertainment.

- Spring promotional campaigns were a key driver. Many retailers used mid-season discounts and new product drops to re-engage consumers after a quieter February.

- Retailers offering bundled deals or price-matched offers on high-interest items saw better conversion, particularly online.

- The arrival of Mother’s Day supported gifting-led purchases, with personal care devices and smart home accessories among the most popular items.

- Electricals remain on a defined upgrade cycle for many consumers. Products bought in 2020–21 are beginning to show signs of wear or obsolescence, prompting timely replacements.

- While consumers remain cost-sensitive, there is still an appetite for upgrades where perceived value or utility is high.

- Smaller appliances and personal electronics outpaced larger ticket items. Consumers were more willing to spend on blenders, air fryers, hair tools and headphones than big-screen TVs or white goods, where demand remains more price-elastic.

- However, certain segments like home entertainment tech still saw gains, helped by warmer weekends prompting earlier seasonal purchases for garden parties and home gatherings.

Take out a FREE 30 day membership trial to read the full report.

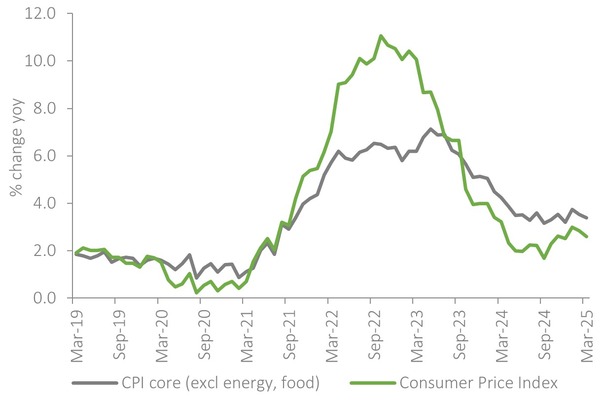

The Consumer Price Index rose by 2.8% in February year-on-year

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis