UK DIY & Gardening Sector Report summary

September 2023

Period covered: Period covered: 30 July – 26 August 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales fell xx% YoY in August according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

ONS data shows the wider Household Goods category faced xx% YoY shop price inflation in August, pointing to a decline in sales volumes.

Tough macro backdrop

DIY & Gardening remained subdued in August against the backdrop of a weak housing market, and persistent high living costs.

August saw headline inflation ease to 6.7% YoY, the lowest reading since February 2022, while core inflation also fell below forecasts.

In addition, earnings growth exceeded price rises for the second consecutive period,, but still remains far below pre-pandemic levels.

Consumer confidence rose five points in the month to -25.GfK’s major purchase index also rose by eight points, pointing to relatively higher demand for big-ticket home improvements purchases.

However, both confidence measures remain firmly in negative territory and the increases come on the back of an unexpected drop in July, with demand remaining curtailed by the macroeconomic backdrop.

An increase in interest rates from 5% to 5.25% at the beginning of the month put a further dampener on buyer confidence while also putting pressure on housing market activity.

Wet weather

Following uncharacteristically poor weather in July, August saw a return to more predictable conditions.

Cool and damp weather during the month resulted in strong demand for outdoor plants and seeds & bulbs, which saw sales increase by xx% and xx% in August respectively (GCA).

However, a combination of cooler weather, widespread travel abroad, and reluctance to spend on big-ticket items resulted in sales of barbecues and garden furniture falling by xx% in the month.

Housing market in decline

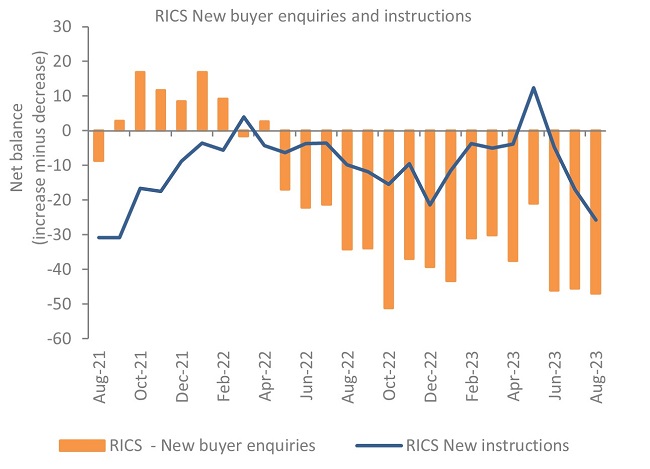

The housing market, a key driver of DIY & Gardening sales, continued to cool in August after half a year of steady recovery came to an end in July.

UK house prices declined steeply on both an annual (-4.6%) and a monthly (-1.9%) basis in the month (Halifax).

This was mainly driven by higher borrowing costs as a result of consecutive interest rate rises, but was also exacerbated by a seasonal dip in market activity and annual comparisons with record-high prices in the summer of 2022.

Take out a FREE 30 day membership trial to read the full report.

Significant headwinds in the housing market

Source: RICS

Source: RICS