UK DIY & Gardening Sector Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales fell by xx YoY in February according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

ONS data shows the wider Household Goods category faced shop price inflation of xx in February, pointing to a decline in sales volumes.

Sales volumes in the wider Household Goods category fell xx YoY in the month (ONS).

Retail Economics forecasts DIY & Gardening to return to growth in 2024, rising xx YoY, with total sales nearing £xx.

DIY deprioritised

DIY & Gardening was the xxx performing sector on an annual basis for the xxx consecutive month in February.

Spending on home improvements remains low on consumers’ priority lists, with performance being further worsened by poor weather in the month.

Inflation eased to the lowest level since xx in February, rising by xx YoY but remains higher than the Bank of England’s 2% target.

A notable easing of restaurants and hotels inflation was recorded, making spending in this already resurgent sector increasingly accessible to households, in many cases at the expense of household goods.

Despite a gradually improving macroeconomic backdrop, consumer confidence fell by two points to xx in February 2024, according to GfK, although all measures remained higher than a year ago.

Notably the Major Purchase Index fell by five points to xx in the period, suggesting reluctance to make major purchases, particularly among mortgagors and private renters who continue to face high living costs.

Poor garden centre sales

Exceptionally wet weather was recorded across the UK in February, with the South East experiencing the wettest February on record.

This negatively impacted demand for gardening products, which would usually be expected to pick up as spring approaches, with sales of houseplants (xx) and hard landscaping (xx) falling on an annual basis.

Elsewhere, sales of garden furniture and barbecues continued to fall on an annual basis (xx), reflecting a persistent reluctance to spend on big-ticket items for the home and garden.

Take out a FREE 30 day membership trial to read the full report.

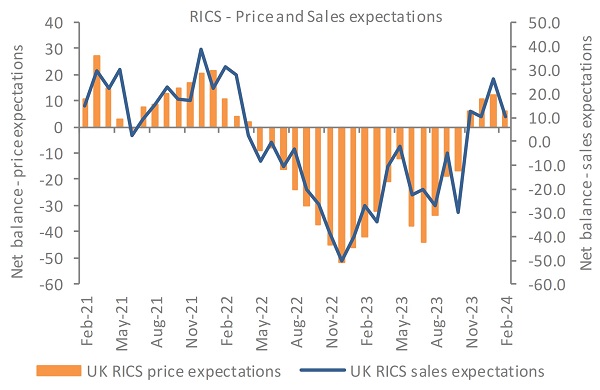

Prices and sales expectations improve

Source: RICS

Source: RICS