UK Clothing & Footwear Sector Report summary

March 2022

Period covered: Period covered: 30 January – 26 February 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing (00%) and Footwear (00%) surged in February, boosted by comparisons with last year’s lockdown. Compared to February 2020 pre-pandemic, Clothing sales were up 00% while Footwear was up 00%.

All remaining Covid-19 restrictions were lifted in February, and as the UK learns to ‘live with Covid’, people are socialising and commuting more frequently, boosting demand for new outfits.

How are retailers responding to inflation?

Inflation surged to a 30-year high in February at 00% YoY (CPI). This is being driven by steep rises in the price of staples such as food and energy, while Clothing & Footwear inflation hit a record high of 00% during the month.

The cost of fuel and raw materials has soared, including cotton, which hit record highs last year. Shipping costs also remain elevated, and a lack of warehouse space is driving up inventory expenses.

Such disruption is undermining some business models more than others. Whereas luxury brands have more pricing power and higher margins to manage cost pressures, fast fashion retailers are centred on low prices, thinner margins and rapid lead times.

Most retailers will have no choice but to raise prices this year, as profit margins were already being squeezed even before the pandemic. But, in an ultra-competitive market like apparel, price rises need to be carefully targeted, limited to certain ranges or types of products where possible, and communicated to consumers effectively if retailers are to preserve their market position.

Sector outlook

Clothing & Footwear demand should return with more consistency over 2022, and more aligned with pre-pandemic levels, helped by the return of social occasions (e.g. holidays, weddings, nightlife).

Retail Economics forecasts Clothing sales to grow by 00% YoY in 2022, reaching £00bn, and Footwear sales to rise by 00% YoY in 2022, reaching close to £00bn.

In the months ahead, we will continue to see the switch from the pandemic being the dominant factor driving retail sales trends and shopping behaviour towards the growing impact of inflation, as consumers and retailers grapple with steep price rises.

Take out a FREE 30 day membership trial to read the full report.

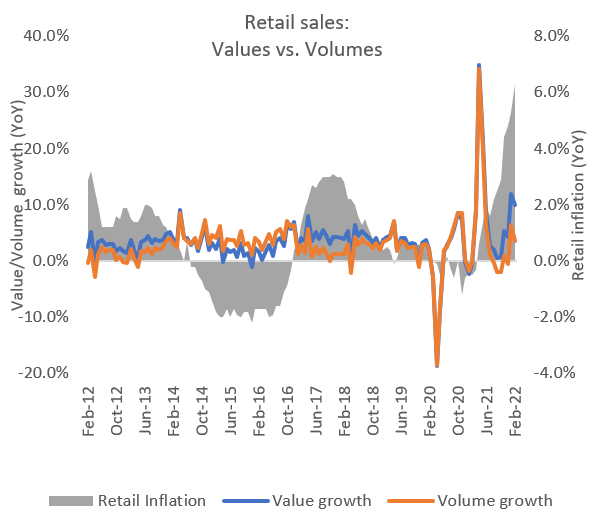

Value and volume growth detaching as inflation surges

Source: ONS, Retail Economics

Source: ONS, Retail Economics