UK Clothing & Footwear Sector Report summary

March 2021

Period covered: 31 January – 27 February 2021

Note: Reporting periods are either one or two months behind the current month as standard reporting practice. Certain data is undisclosed. Take out a free 30 day subscription trial to access this data or subscribe.

Both Clothing & Footwear remained in deep double-digit decline under the third national lockdown in February. Clothing & Footwear retailers have been among the hardest hit since the pandemic, as Covid restrictions limits demand for new outfits.

But recent declines have not been as severe as during the first national lockdown. Investment in online capabilities by retailers has improved capacity, while consumers are more willing to switch between channels after a year of restrictions,

Clothing retail sales declined by 00.00% year-on-year in February, according to Retail Economics.

Social restrictions and the staggered reopening of the economy has seen a shift in the types of clothing products that can typically be expected to be bought this time of year.

But as lockdown measures gradually ease, the re-opening of schools at the beginning of March saw a ‘back to school’ flurry, which would normally be expected at the end of December for a January return.

The step change in the proportion of sales online has polarised the performance between fast growing online-only players and mothballed high street giants. Multichannel retailers sit somewhere between the two ends of the spectrum, depending how well their digital propositions align with new customer expectations.

The disruption caused by the pandemic is unsustainable, and government support over the past year has been a lifeline to many. But fallout is inevitable, with the likes of Arcadia and Debenhams collapsing as cashflow stalls and brand relevance comes under pressure.

This has led to a rise of consolidation and partnerships as fashion retailers look to share costs and build scale to broaden their customer reach.

In March, department store giant Next and fashion retailer Reiss entered a strategic partnership, with Next to acquire a 25% stake in the fashion brand in return for £33m equity investment and £10m debt investment in Reiss.

Online Clothing & Footwear sales growth slowed in February, rising by 35.6% in February year-on-year. Demand was said to have picked up after the government's announcement of the roadmap out of lockdown.

Resultantly, sales growth remained below the three-month average of 43.8%, but outperformed the 12-month average of 26.5%.

Online sales of Clothing & Footwear accounted for 00.00% of total retail sales in February, up from the 20.1% proportion a year ago – a new record high.

Take out a free 30 day trial subscription to read the full report >

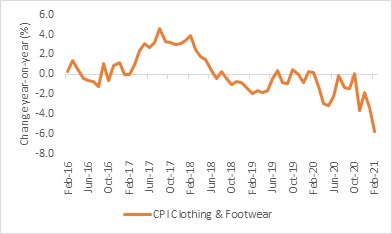

Clothing & Footwear inflation declines at fastest rate in over a decade

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis