UK Clothing & Footwear Sector Report summary

February 2024

Period covered: Period covered: 31 December 2023 – 27 January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales increased by xx% YoY in January, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Apparel inflation is running at xx%, suggesting further volume declines.

Clothing & Footwear sales’ performance in December reflects several downside (-) factors, including:

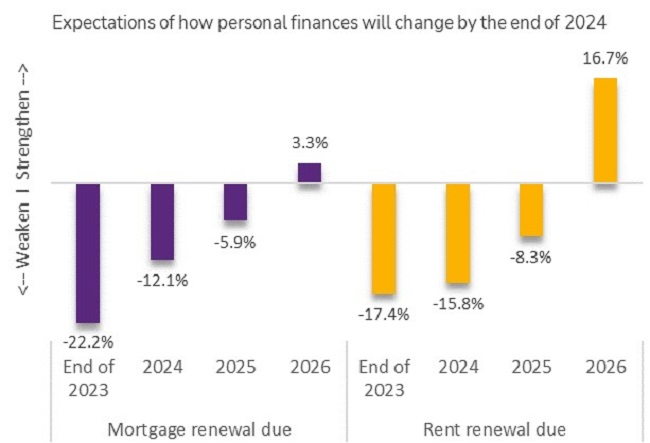

Financial pressures (-): Consumers continued to feel squeezed by cost of living pressures, with those with mortgages, and private renters, increasingly the hardest hit as more fixed term loans come to an end and shift on to higher interest rates.

Stormy weather (-): Three separate storms and amber weather warnings impacted footfall in January. Snow in the north of England and Scotland also contributed to keeping shoppers at home.

Focus on wellbeing (-): When shoppers did spend, they did so in categories aligned with their new year wellbeing goals. Food (+xx%) and health and beauty (+xx%) benefitted from health and wellbeing goals, while clothing, DIY and homewares lost out.

Train strikes (-): While the RMT union called off a four-day strike in mid-January at the last minute, the spectre of a strike was enough to negatively impact city centre shopping trips and commuting footfall.

Consumer spending

While inflation is easing – the headline CPI rate was 4% in January – household finances are yet to return to their pre-pandemic levels after 18 months of real income declines. Inflation is not likely to reach its 2% target until late 2025.

The average household moving onto a 5% mortgage deal now will need to pay an extra £xx a month in repayments in 2024, according to Retail Economics analysis

Between 2021, when interest rates started to rise, and the end of 2024, over xxxx xxxxhouseholds will move from fixed rates of an average 2% to new deals of an average of 5%.

As a result, improvements in sales volumes of goods and services is expected to come from the most affluent – those who are mortgage free – with low and middle earners more squeezed.

Consumer confidence remains negative at the start of 2024, with persistent inflation, geopolitical instability and high interest rates impacting how consumers feel about their financial situation and their spending intentions.

Discounting driving sales

Discounting and deals remained a key driver of sales in January, with squeezed shoppers continuing to hunt for bargains. With real wage increases set to be weak in 2024, shoppers are likely to remain value-driven.

However, all eyes will be on the budget on 6 March. While the mood so far in 2024 is lacklustre, any tax cuts announced ahead of a 2024 election could shift sentiment quickly.

Take out a free 30 day trial subscription to read the full report.

The Fixed Mortgage Lottery

Source: Retail Economics, NatWest

Source: Retail Economics, NatWest