UK Clothing & Footwear Sector Report summary

December 2023

Period covered: Period covered: 29 October – 25 November 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales grew 00% YoY, while Footwear sales grew by 00% YoY in November, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted). While this indicates an improvement in sales for the sector compared to October, apparel inflation is running at 00%, suggesting continued volume declines.

Clothing & Footwear sales’ slow performance in November reflects several downside (-) factors, including:

Cold weather (+): Storms in the first half of the month, and a cold snap towards the end of the month, created better conditions for retailers selling winter ranges. In the final week of November, some areas of the country experienced snowfall with the Met Office issuing a weather warning on 28th.

Minimum Wage (+/-): The Autumn Statement included an announcement that the minimum wage will rise 9.8% in April 2024 to £11.44. This is good news for consumer spending but equates to a 20% rise in just two years, burdening retailers with higher wage costs.

Business Rates (-): While a freeze on rates multipliers and an extension of 75% relief until 2025 was good news for independents, the Autumn Statement offered no relief for larger fashion retailers and failed to tackle the need for broader business rates reform.

Economic rallying

The economy is not out of the woods yet, but there was encouraging news in November. Inflation fell more than expected to 3.9% from 4.6% in October, well below forecasts of 4.4%. On a monthly basis, prices fell by 0.2%. Consumer confidence also rallied in November, rising six points to -24, according to GfK, with improvements across all measures. Barclaycard data showed that Britons’ confidence in their ability to spend on non-essential items (56%) reached its highest level since April.

Spending restraint

However, consumers are still feeling the impact of 2023’s cost of living pressures, with interest rates still high and elevated mortgage costs impacting people’s ability to spend. Food inflation rose 9.2% YoY in November, according to the ONS – while this is the lowest it has been since May 2022, food and housing costs are continuing to eat into shoppers’ disposable incomes.

As a result, shoppers are tightening their belts. Data from Barclaycard suggests that despite an uplift in confidence in their personal finances, shoppers remain restrained, with 00% saying they are actively seeking out deals and discounts more than they used to.

Economic growth is also stagnating in the face of tightening budgets, with the ONS reporting that GDP fell 0.1% in the third quarter of 2023, driven by a contraction in household expenditure.

Take out a free 30 day trial subscription to read the full report.

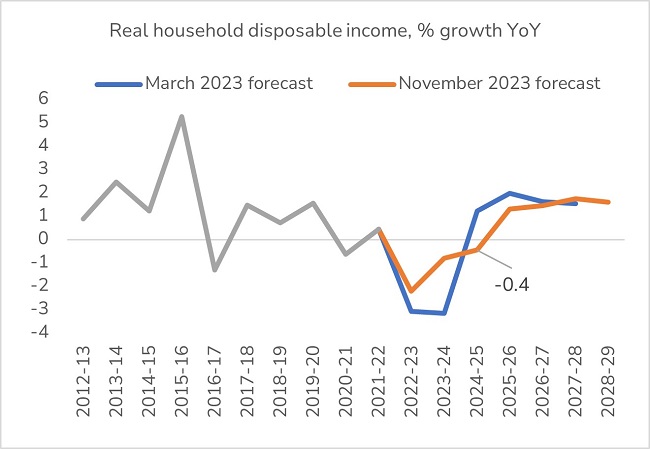

Household disposable incomes set to stay negative over 2024, as wage growth slows and inflation persists

Source: OBR, Retail Economics

Source: OBR, Retail Economics