UK Clothing & Footwear Sector Report summary

December 2020

Period covered: Period covered: 01 Nov 2020 – 28 Nov 2020

Retail sales rose by 2.3% in November, year-on-year, according to Retail Economics. Total online retail sales rocketed by 79.6% in November, value and non-seasonally adjusted, according to ONS. Shop price inflation dipped by 1.2% in November, excluding fuel, according to ONS. Clothing retail sales declined by 19.2% in November, year-on-year, value and non-seasonally adjusted, according to Retail Economics. Average weekly sales for Clothing were £711m in November, according to Retail Economics.

Clothing –Retail Economics Index: November 2020

As non-essential stores were forced to pull down shutters, Clothing saw a steeper rate of decline in November than in recent months, with sales down by 19.2%. Delving behind headline figures, the uneven impact across product lines and channels is leading to… read more

Lockdown impact

The four-week closure of all non-essential shops came at the category’s busiest time of year, during the critical golden quarter. As a direct result of the second lockdown, Retail Economics data shows that nearly one in five shoppers (18%) delayed spending on Clothing – more so than any other retail category. This suggests there could be pent up demand in the future, but some of that could simply lead to lost demand among fashionable and seasonable lines as the UK faces ongoing Covid restrictions.

Channel redistribution

Stay at home shoppers created an uneven impact between dwindling footfall and a sharp shift towards online shopping – which polarises the pace at which retailers can hope to recover. Footfall at retail destinations was dismal, declining 59% month-on-month across high streets and shopping centres in November. However, retail parks again proved more resilient, with falls of ‘just’ 28.2% (Springboard).

Black Friday deflation

Black Friday clearly supported category sales. Retail Economics research shows that more than one in 10 consumers (12%) purchased clothing products during the November sales event, just behind the popular Electricals category. Critically, Black Friday turned into 'Black November' this year, as retailers deployed early discounts to flatten the peak of online sales volumes. As early as 9 November, one in 10 UK retailers were running an online Black Friday campaign – over triple the level seen a… read more

Footwear – Retail Economics Index: November 2020

Footwear lingered at the bottom of growth rankings in November, with sales down by 22.3%. Similar to Clothing, factors ranging from working from home, cancelled events and less time spent outdoors decimated footwear demand. This disproportionately impacts seasonal lines and formalwear, while children’s ranges remain relatively robust as children remained in school.

High street on the back foot

With average sales down more than a fifth (-21.5%) on a six-month rolling basis, the cumulative effects of two lockdowns and restrictions have put unbearable strain on the balance sheets among legacy footwear businesses. Small and legacy players are facing competition from online players and large groups, better able to adapt to trends as shoppers are forced to shun the… read more

Government support

The short-term outlook remains bleak for footwear retailers into 2021. As England entered a third lockdown, the government has once again stepped in to avoid a ‘cliff edge’ of unemployment. In early 2021, a £4.6bn support package was announced for retail, hospitality and leisure businesses forced to shut once more. While providing some short-term respite, what will become critical in the success of stimulus going forward is how government support extends into (and beyond) a recovery period.

Online Clothing & Footwear – Office for National Statistics – November 2020

Online Clothing & Footwear sales growth accelerated in November, rising by 52.4% year-on-year, against a 1.1% fall in the same month a year ago – a new record high. The improved performance was driven by a combination of stores being closed throughout the month, weak comparisons a year ago due to the timing of Black Friday as well as a longer promotional period during the sales event this year. Resultantly, sales growth outperformed the three-month and 12-month averages of 38.4% and… read more

Macro Factors – Consumers

Household consumption rose by 18.3% in Q3 2020 on the previous quarter, totalling £294,468m. This follows a 23.6% contraction in the previous quarter. Household consumption remains 12.4% below its Q4 2019 level. GfK’s Consumer Confidence fell by two points to -33 in November, 19 points lower than in the same month a year ago and the lowest reading since May. Three measures within the index decreased compared to the previous month while two remained unchanged. Tighter restrictions and rising cases of the coronavirus weighed on the index in November.

Macro Factors – Ipsos Retail Performance

As a result of the government imposing new lockdown restrictions and the closure of non-essential stores in November, IPSOS did not track shopper numbers in November. However, IPSOS forecast overall UK footfall to fall by 55.7% in December 2020 compared to the same month a year ago. The steepest declines in footfall are anticipated to be in Scotland & N Ireland (-69.5%) and Northern England (-61.4%).

Macro Factors – Labour Market

The latest ONS labour market data shows some recovery in hours worked, despite redundancies hitting a record high as hospitality and physical retail remains under intense pressure from Covid-19 restrictions. The number of paid employees is down some 819,000 in November compared with March 2020 according to flash estimates using PAYE data. However, the largest falls were seen at the start of the coronavirus outbreak. Hospitality has been the hardest hit, with 297,000 fewer payroll workers since the start of the pandemic.

Macro Factors – Earnings

For October in nominal terms (unadjusted for price inflation): Average regular pay (excluding bonuses) for employees in Great Britain was £527 per week before tax and other deductions from pay – up from £509 per week a year earlier Average total pay (including bonuses) for employees in Great Britain was £560 per week before tax and other deductions from pay.

Macro Factors – Costs, Prices and Margins

Sterling’s trade weighted index rose in November, up 1.1% on the previous month. The index has been impacted by the ongoing uncertainty surrounding Brexit negotiations with a deal between the UK and EU not yet reached. In terms of exchange rates, the £/$ rate is currently around 1.34, while £/€ dipped to around 1.10. Both commodity indexes we track rose in December. Indeed, the Thomson Reuters CRB Index fell by 10.9% year-on-year from -15.6% in November, compared to a 24.3% annual fall for the GSCI Commodities benchmark. The improved outlook for global economic growth was… read more

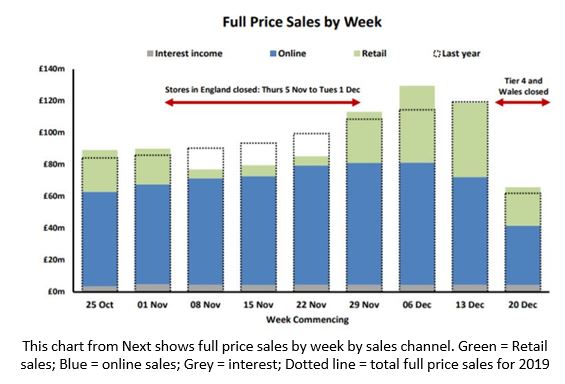

Online and retail park sales benefit Next

Source: Next

Source: Next