UK Clothing & Footwear Sector Report summary

August 2023

Period covered: Period covered: 02 – 29 July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell 1.1% YoY, and Footwear sales increased 0.5% YoY in July, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Uncharacteristic poor weather in July put a dampener on sales of Clothing and Footwear, as average temperatures remained below 20 ° C for much of the month. July was additionally the wettest and dullest for over a decade.

This marked a sharp contrast with July 2022, where temperatures reached 40 °C on certain days, resulting in tough annual comparisons for clothing and footwear sales.

Seasonal clothing lines suffered with retailers having to stimulate demand using discounts and promotions.

On the other hand, beachwear and other holiday lines performed well on the back of strong demand for holidays abroad, corresponding to increases in spending on airlines, travel agents and resorts in the month.

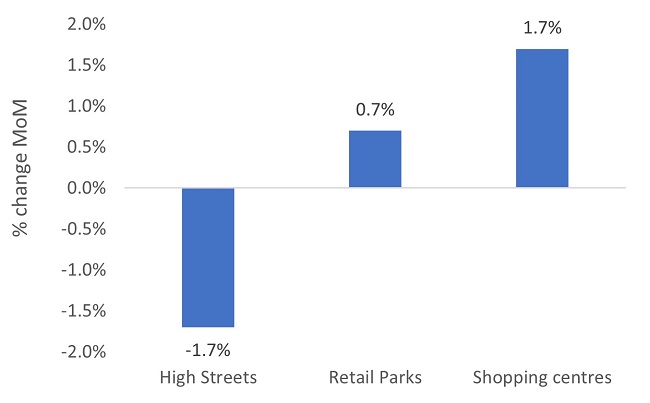

Overall footfall across destinations fell xx% from June to July as a result, following a xx% rise from May to June (Springboard).

This marked the first time that July’s footfall was lower than June’s since MRI Springboard started publishing its data in xxxx.

While high street footfall fell considerably, retail parks and shopping centres saw an increase in footfall as tried to avoid the rain.

Low Confidence

The effects of macroeconomic uncertainty on consumer confidence can be seen in Retail Economics’ Shopper Sentiment Survey.

The survey found that xx% of consumers expect the economy to weaken over the next three months, little changed from the previous quarter.

xx% of consumers said they were a little concerned with their personal financial situation in July, up from 35% in April.

xx% of consumers have concerns about their level of credit card debt, up from xx% in the previous quarter, while half of consumers indicated they would spend less on non-essential items over the next quarter, up from xx% in April.

Spending on non-essential clothing and footwear items therefore remains under pressure, with consumers constantly on the lookout for compelling deals and discounts.

Take out a free 30 day trial subscription to read the full report.

Consumers shopped at retail parks and shopping centres to escape the rain in July

Source: Springboard

Source: Springboard