Report Summary

Period covered: Q1 2023

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Gross Domestic Product

UK quarterly GDP is estimated to have increased by xx% in Q1 2023 (Jan to Mar).

In Q1, services output grew by xx%, production growth grew by Q1, and construction grew by xx%.

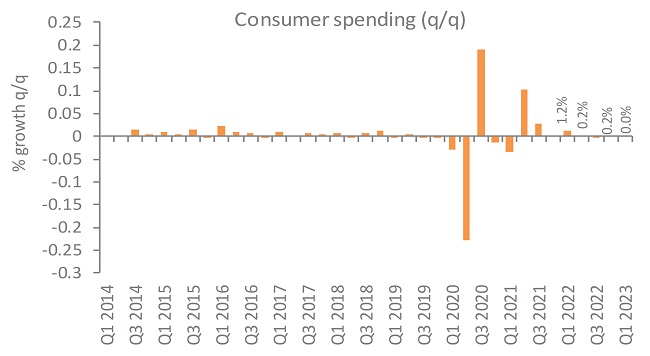

Total Consumer Spending

Consumer spending growth was xxxx QoQ in Q1 2023.

Half of the categories recorded a QoQ rise in spending in the first quarter of 2023 with Communication (xx%) and Clothing and Footwear (xx%) the strongest performers.

Conversely, spending on Alcoholic Beverages (xx%), and Health (xx%) experienced the deepest contractions QoQ.

Food and Non-Alcoholic Beverages

Consumer expenditure on food and non-alcoholic beverages fell by xx% on the previous quarter, totalling £xxxx in Q1 2023. Spending also declined xx% compared to the same quarter a year ago.

Alcoholic Beverages and Tobacco

Consumer spending on Alcoholic Beverages & Tobacco totalled £xxxx in Q1 2023, a xx% decline on the previous quarter.

The decline was driven by the Alcoholic Beverages component which fell xx% QoQ and xx% YoY.

Clothing and Footwear

Consumer expenditure on Clothing & Footwear grew by xx% in Q1 2023 with spending totalling £xxxx. However, spending decreased by xx% YoY.

Quarterly growth was driven by the Clothing category with spending up xx% compared with a xx% increase for Footwear.

Housing, Water, Electricity, Gas and other fuels

Total spending on Housing, Water, Electricity, Gas & other fuels rose by….

Take out a FREE 30 day membership trial to read the full report.

Consumer spending remains subdued

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis