UK Retail Sales Report summary

October 2023

Period covered: Period covered: 27 August - 30 September 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales

Retail sales growth softened to just xx% YoY growth in September according to the Retail Economics Retail Sales Index, against a xx% rise in the previous year as non-food sales came under pressure.

Key factors impacting sales in the month include:

Ongoing cost of living pressures: Inflation remained unchanged and above-target at 6.7% in September, driven by essential fuel prices and double-digit food inflation. Additionally, mortgage rates and rents are under pressure from the base rate being held at 5.25% on 21 September. This is leading to a readjustment of household budgets for retail spending.

Fragile confidence: Confidence slipped back as the month went on into October, which saw willingness to make major purchases plummeted 14 points to -34 between September and October (GfK).

Joint-warmest September on record: The roll out of new season autumn/winter lines came up against record temperatures in September (Met Office), delaying sales of jumpers, blankets and duvets.

Back-to-school rush: Sales of school essentials such as uniforms, formal shoes and backpacks came later than normal as households delayed spending.

Exceptional comparative: The death of the Queen last year led to an additional public holiday and shop closures.

Evolving Cost of Living pressures

The harsh macroeconomic backdrop continues to hamper confidence.

Confidence hit an all-time low in September last year, coinciding with political turmoil including Liz Truss and Kwai Kwarteng controversial mini-budget. While pessimism has eased since then, GfK’s index measure slipped from -21 in early September to -30 by early October.

This reflects evolving pressures on personal finances despite resilient earnings growth.

The latest earnings growth shows annual regular pay rises were 7.8% between June to August 2023 (Office for National Statistics data) – broadly in line with record highs. However, the distribution of pay rises is uneven across households.

Some industries seeing the highest pay increases are benefiting the most affluent individuals, such as those working in professional services (earnings up 7.9% YoY), real estate (8.1%) and ICT (10.0%), which have typically high starting salaries to begin with.

By comparison, industries such as arts and entertainment (+3.0%), food manufacturing (+4.3%) and quarrying (+5.4%) are facing softer earnings rises.

Take out a FREE 30 day membership trial to read the full report.

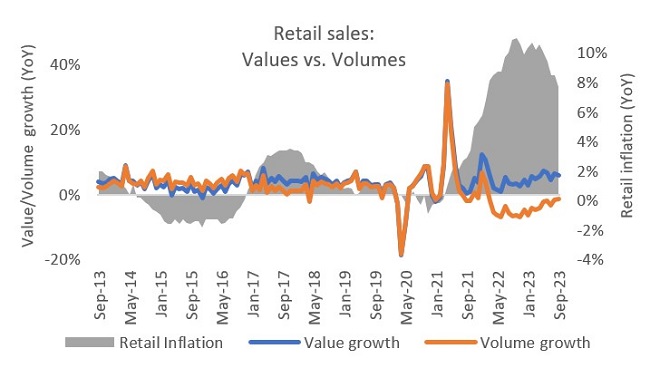

Retail sales values and volumes continue to diverge

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis