UK Retail Sales Report summary

January 2024

Period covered: Period covered: 26 November - 30 December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales

Retail sales growth rose by a disappointing xx% YoY in December according to the Retail Economics Retail Sales Index.

Key factors impacting sales in the month include:

Recessionary behaviours: Shoppers are spending cautiously, focusing on promotional activity to manage squeezed finances, which impacted the pattern of traditional Christmas trading across the golden quarter.

Real wage rises: Wage growth has outpaced inflation for half a year (regular pay up 6.6% YoY in the quarter to November, ONS), but it’ll take several years for household finances to recover to pre-pandemic levels following the cost-of-living crisis. Real wage growth does not capture the impact of elevated borrowing costs on household finances, disproportionately impacting middle-income and millennial mortgagors.

Mild December: Despite a cold snap in the first week, it was the joint-fifth warmest December for England and Wales (Met Office, records began in 1884). This impacted winter lines across apparel and homewares.

Exceptional comparatives: December 2023 sales compared to 2022’s high energy prices, freezing temperatures and the first Christmas in three years with no Covid restrictions. This enticed spending on winter warmers across apparel and homewares that were unable to be replicated this Christmas.

Cautiousness is having a severe impact on retail, as it competes for spending with other areas of the economy. Three quarters of consumers say they became more cautious with their spending in Q4 2023.

Although this marks a slight improvement on an average of 78% throughout 2023, it is a considerable step up from a pre-pandemic average of 50%.

Food outperforms

The impact of cut back behaviours across retail have become visible across food and non-food.

Food outperformed in December as families indulged in festivities. Supermarkets had their busiest Christmas since 2019, hitting a record £13.7bn of sales in the four weeks to 24 December (Kantar). But this was driven by promotional activity between major grocers, which helped food inflation ease to 8.0% in December from 9.1% in November.

Grocery shoppers are putting greater emphasis on promotions and own-label lines – supporting the market share of those with strong value propositions. Lidl maintained its position as the fastest growing grocer (sales +13.8% in the 12-weeks to 24 December), helped by its own-brand premium label Deluxe, which saw sales increase by 11% in the four weeks to 24 December.

Sainsbury’s and Tesco also gained market share, benefiting from member-exclusive prices as shoppers look for clear monetary rewards for loyalty. Tellingly, almost a third of all spending at Sainsbury’s came from products on promotion.

Take out a FREE 30 day membership trial to read the full report.

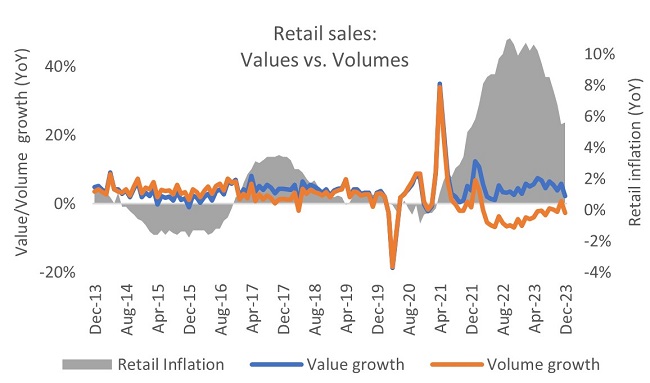

Volumes into decline in December

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis