UK Retail Sales Report summary

December 2023

Period covered: Period covered: 29 October – 25 November 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales

Retail sales growth rose by a soft xx% YoY in November according to the Retail Economics Retail Sales Index, against a xx% rise in the previous year.

Key factors impacting sales in the month include:

Extended Black Friday deals: Many retailers extended Black Friday deals throughout November. But early Black Friday momentum wasn’t sustained as households spent cautiously across non-essentials. Black Friday sales are typically concentrated around Electricals, which recorded the deepest declines in November.

Variable weather: Typical seasonal items were impacted by changing weather patterns. The first half brought Storm Ciaran and Storm Debi, while the second half of the month brought generally milder weather and ultimately above-average sunshine hours.

Wages rising faster than prices: Inflation fell to its lowest rate since September 2021 at 3.9% in November, which means regular pay has turned positive in real terms following declines through much of 2022/23.

Mortgage pressure: Average fixed rate two-year mortgages were at 5.3% in November. Although easing on recent months, it is set to see average repayments rise by around £220 per month among those renewing from rates of 2%, disproportionately impacting middle-income, millennial mortgagors.

Evolving economic conditions

The backdrop for consumer spending appears to be improving on recent months, but there are a number of uncertainties distorting the pace of recovery for retail.

For retailers, cost price inflation has eased significantly in recent months. Supply chain pressure has eased over 2023, including input PPI (inflation faced by businesses) falling into deflation in the second half of 2023 and container costs around pre-pandemic norms. This is putting pressure on businesses to pass on savings to consumers to drive sales.

Indeed, inflation fell faster than officials expected in November to the lowest rate since September 2021 at 3.9%. Although wage growth has also slowed, easing inflation means regular pay has turned positive in real terms.

This has had a significant impact on consumer confidence, with GfK’s index measure rising six points to -24 in November. Although decidedly negative, importantly the major purchases index rose 10 points to -24.

Take out a FREE 30 day membership trial to read the full report.

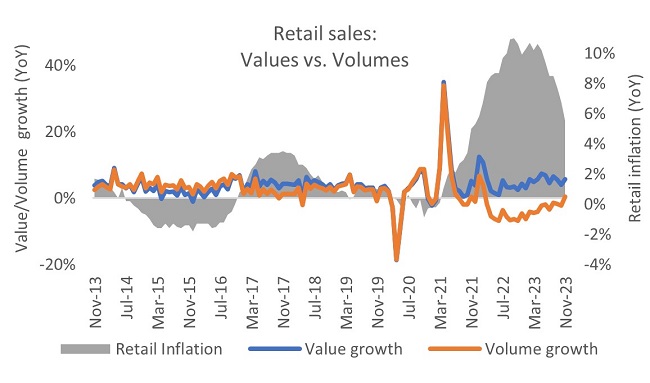

First sales volume increase since February 2022

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis