UK Homewares Sector Report summary

January 2024

Period covered: Period covered: 26 November - 30 December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales fell by xx% YoY in December, according to the Retail Economics Retail Sales Index.

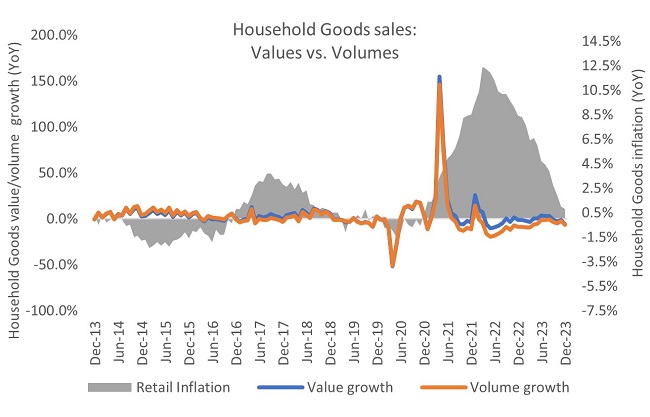

ONS data shows the wider Households Goods category faced xx% YoY shop price inflation in the month, pointing to a decline in sales volumes.

ONS data shows sales volumes in the wider Household Goods category fell by xx% YoY in December.

Tough macroeconomic conditions

Homewares sales performed poorly in December as cash-strapped households diverted discretionary spending towards festive staples.

Living costs remain relatively high, as inflation edged up from 3.9% to 4.0% and food prices remain up 26% in the two years to December 2023 (ONS).

Nonetheless, prices rose at the lowest rate since September 2021 in the month, contributing to a stabler consumer confidence reading of -22, up two points on the previous month, albeit firmly in negative territory (GfK).

Sales of homewares and smaller household goods were more resilient than those of big-ticket counterparts, with strong demand for winter essential goods, Christmas gifts, and seasonal decorations to enhance home environments ahead of festive gatherings.

However, overall retail discretionary spending was directed towards groceries for festive gatherings, as well as affordable indulgences that offer a feel-good factor, such as Health & Beauty for gifts.

Housing market cools

UK house prices rose on both an annual (1.7%) and a monthly (1.1%) basis in December, according to Halifax.

This primarily reflects dwindling supply as homeowners hold back from selling until macroeconomic conditions improve, rather than a substantial increase in buyer demand.

Mortgagors are increasingly adjusting to higher interest rates as low-rate fixed deals expire. This will impact 1.6 million households in 2024 exiting fixed rate deals averaging 2%.

For aspiring classes, higher borrowing costs have delayed home projects and reduced intentions to ‘climb the housing ladder’.

This ultimately means fewer Homewares sales are being made as part of house moves, with those households that can afford to do so sprucing up current home environments.

That being said, buyer confidence is beginning to rise from weak levels. Estate agents surveyed by RICS express improving levels of buyer enquiries, new instructions and agreed sales from firm negative territory in December.

This is the result of easing mortgage rates from recent highs, as well as earnings growth having outpaced inflation for half a year.

But significant pressure remains on renters, skewed towards middle income, younger consumers . A balance of +50% of estate agents expect short term rental prices to rise, as the supply of rental properties declines and landlords pass on higher borrowing costs.

Take out a FREE 30 day membership trial to read the full report.

Inflation is easing but volumes remain in decline

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis